As the clock ticks towards the end of government support schemes such as the deadline for the tenant eviction moratorium and the business rates holiday, we consider the ‘frozen’ market of stores that closed back in March 2020 and have been unable (or unwilling) to reopen since.

Recent LDC research found that, by September last year, 83% of the non-essential retail market had reopened following the first lockdown, prior to the restrictions kicking back in in October. However, after closures, this left a chunk of the non-essential retail market ‘frozen’ – stores that had been closed since March, yet not vacated and therefore not counted in our closure or vacancy figures.

To understand the extent and make-up of this market we analysed a sample of ‘non-essential’ units that were visited by our field research team between 1st September and 31st October to understand how many had not reopened when they were legally permitted to do so, following the first lockdown. The analysis excluded any units which had not been able to reopen at all including theatres, night clubs and concert venues.

REGIONAL VARIANCES in reopening

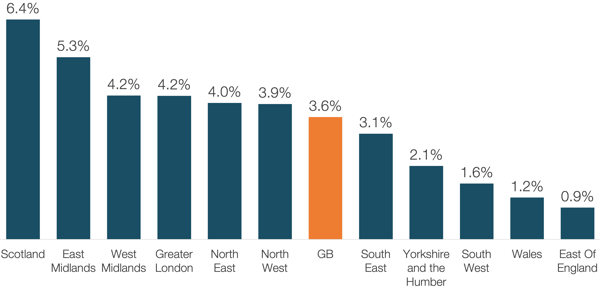

Of the 106,163 units visited in this timeframe, 3,783 had not reopened following their closure in March by the end of October, equating to 3.6% of the sample. Scotland seemed to take the brunt of this hit, with 6.4% of units visited still temporarily closed, compared to the just 0.9% in the East of England.

Scotland’s COVID restrictions have typically been tighter throughout the pandemic, especially for shopping centres which were unable to open until 13th July. Scottish occupiers also faced longer periods of time with restrictions such as curfews and other guidelines which made trading challenging.

Percentage of units remaining temporarily closed since the first lockdown across GB regions/NATIONS

Figure 1: Remaining temporary closure rate by region/nation across sampled sites (Source: Local Data Company)

Figure 1 shows the huge variance in reopening rates across the country, with the East of England sample seeing just 0.9% of units still closed following the first lockdown, compared to the East and West Midlands with 5.3% and 4.2% respectively.

CATEGORY REOPENING TRENDS

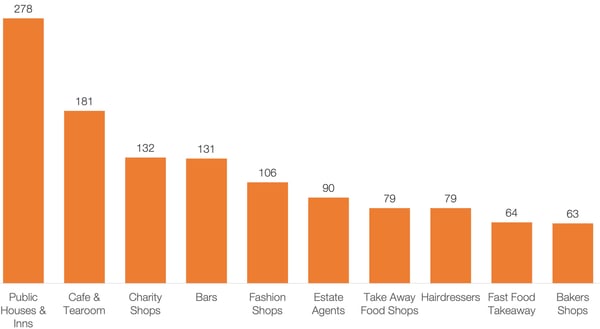

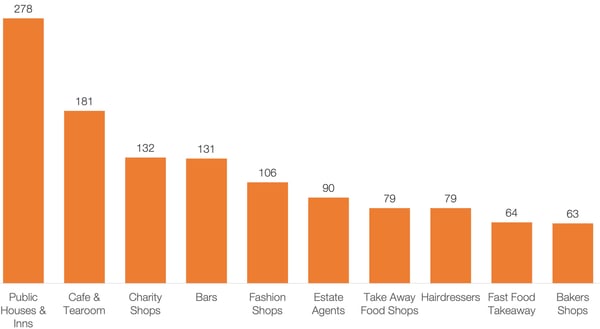

Of the 3,423 pubs that were visited, 278 were still closed (8.1%) and the picture was worse for bars, of which 12.8% were still closed. The hospitality industry arguably has been one of the most impacted with limits on table numbers, restrictions around serving alcohol without a 'substantial meal' and wet-led venues facing challenges around serving takeaway alcohol.

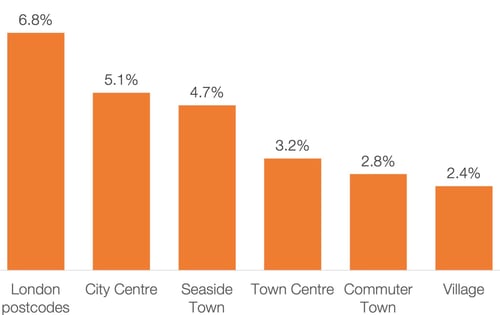

Percentage of units remaining temporarily closed since the first lockdown across town profiles

Figure 2: Remaining temporary closures by category across sampled sites (Source: Local Data Company)

In the sample, 34.6% of cinemas visited had remained temporarily closed. This aligns with announcements from the big chains such as Odeon, which made the decision in October to move 25% of its portfolio to weekend-only opening hours due to the fall in demand and lack of new releases.

RESIDENTIAL AREAS

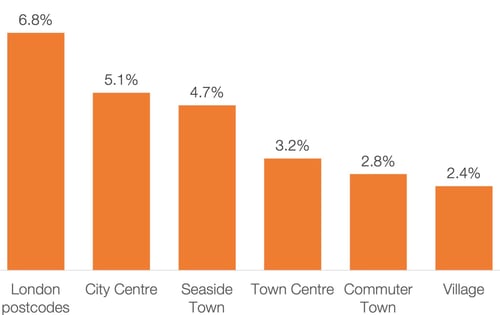

Of the town profiles, (city of) London had the highest rate of remaining temporary closure at 6.8%. This mirrors other trends such as the 47% jump in vacancy seen in the City of London in 2020 which has been impacted by the lack of tourists, office workers and visitors coming through major transport hubs. Greater London as a whole performed slightly better (4.2% of units remaining temporarily closed), boosted by the residential suburbs which were able to retain higher levels of footfall than central areas. Village locations had the lowest temporary closure rate, with only 2.4% of businesses yet to reopen or vacate their premises in spite of being able to trade.

Percentage of units remaining temporarily closed since the first lockdown across town profiles

Figure 3: Remaining temporary closure rate by town profile across sampled sites (Source: Local Data Company)

CHALLENGES FOR SHOPPING CENTRES

Of the three key location types tracked by the Local Data Company, shopping centres saw the highest temporary closure rate at 4.6%, closely followed by high streets at 4.5%. Shopping centres have already been severely impacted by the pandemic with vacancy rates surpassing 17% at the end of last year. Shopping centres have been exposed to some of the most at-risk categories such as fashion and other sectors which have seen huge shifts to online throughout the pandemic. On average, comparison goods stores make up 57% of units in shopping centres, the majority of which are classified as non-essential. On top of this, shopping centres faced some of the toughest challenges around creating covid-safe spaces for consumers due to the indoor nature of the assets which made queuing and social distancing that bit harder.

Research on this frozen market suggests that while we can already evidence the impact of the COVID-19 pandemic on the retail & leisure market, we expect a further shake-out and increase in vacant units across UK shopping destinations.

What will be critical as we move forwards is addressing locations where there is an oversupply in retail property. Redevelopment of space into assets for other use such as warehousing, residential or office space has increased over 300% since 2015 and we expect, as we move out of the pandemic for this to increase further. Rebalancing the amount of retail property to better suit the needs of local catchments will be critical as the country recovers from the pandemic and as we reshape our high streets, shopping centres and retail parks into community-led, attractive and popular spaces.

901

901

901

901