Estimates of train station usage from the Office of Rail and Road (ORR) show notable post-pandemic recovery: from April 2021 to March 2022, 24 train stations in Britain saw over 10 million entries and exits each. Only 5 stations saw these numbers during the previous 12-month period, as lockdown restrictions, home working and concerns over virus transmission saw train usage plummet.

This analysis explores those stations which saw the most and least recovery following the pandemic, and examines how this has impacted the surrounding retail climate within a 500m radius.

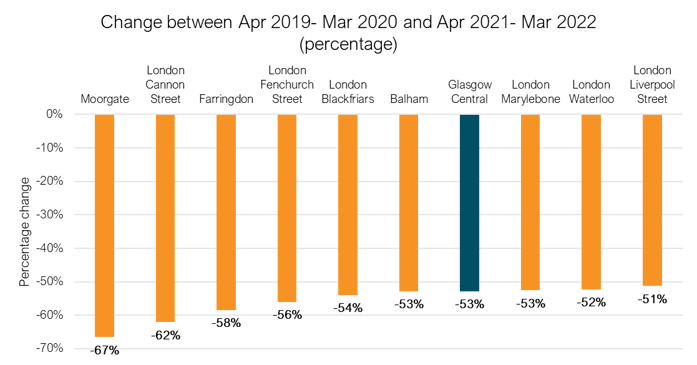

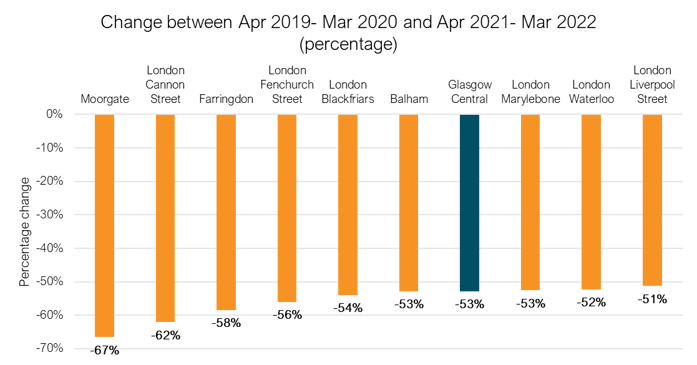

The bottom 10

Moorgate saw the most sizeable drop-off in passenger numbers of any GB train station compared to pre-pandemic figures. This trend is echoed across the worker-dominant City of London market: London Cannon Street, Fenchurch Street, Blackfriars and Liverpool Street all made the bottom 10, with nearly 70 million fewer entries and exits across all of these stations in the 2021-2022 period compared to pre-pandemic.

Glasgow Central was the only non-London train station in the bottom 10. This station was impacted by the slower recovery and reopening in Scotland compared to the rest of Britain, as well as severely reduced worker footfall to the city centre.

Figure 1: Bottom 10 train stations across GB in terms of percentage change in passenger entries and exits, April 2019-March 2020 vs. April 2021-March 2022 (Source: ORR/Local Data Company analysis)

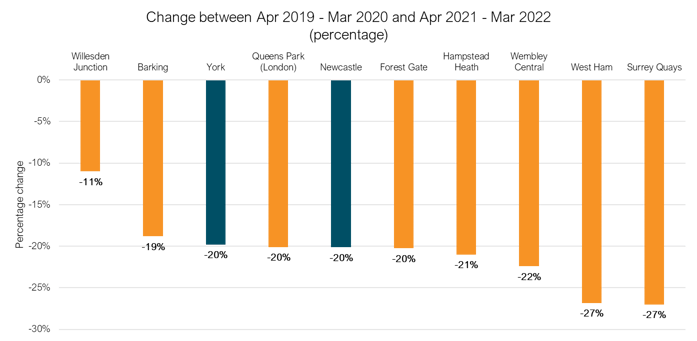

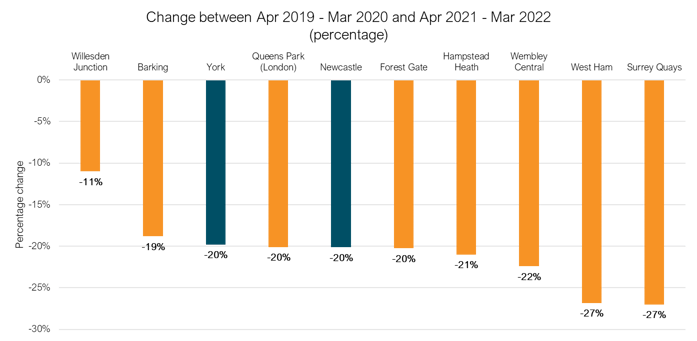

The top 10

The stations that saw the strongest recovery in passenger volumes benefited from the return of sports and music events, the rise in staycations and a smaller proportion of home workers in the local population. Wembley Central, Newcastle and West Ham stations saw notable recovery in passenger volumes, thanks to events such as the Mens’ Euros final hosted at Wembley during the 2021-2022 period.

Recovery for York was likely stimulated by the return of international tourists, as well as domestic visitors choosing the city for a staycation when travel restrictions were in effect.

The reopening of the hospitality sector seems to have lifted weekend passenger volumes at major London connecting stations, particularly Willesden Junction, Surrey Quays and Queens Park. Passenger numbers at these stations was also likely boosted by a higher proportion of workers commuting in rather than continuing to work from home. This is also true in the case of Barking station, which had a higher passenger volume than the King's Cross and Paddington train stations during the pandemic due to a higher number of essential workers.

Figure 2: Top 10 train stations across GB in terms of percentage change in passenger entries and exits, April 2019-March 2020 vs. April 2021-March 2022 (Source: ORR/Local Data Company analysis)

Impact on retail

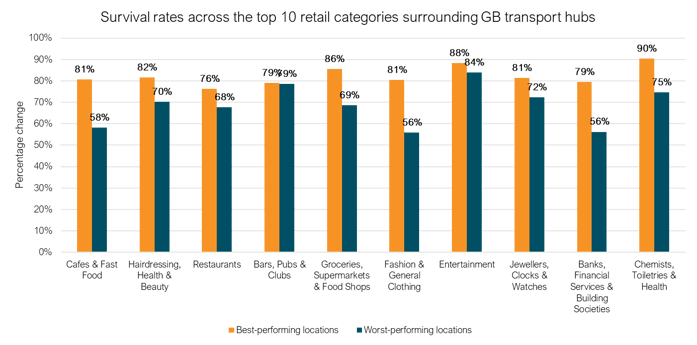

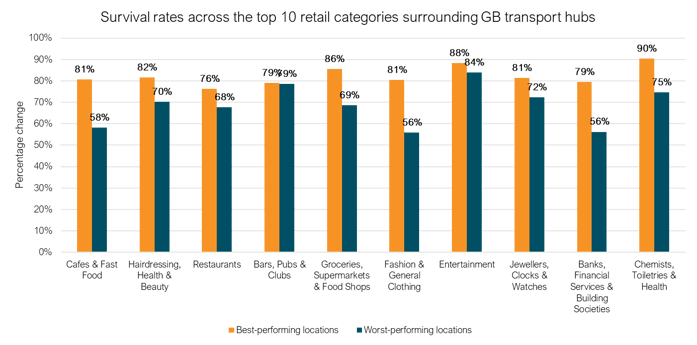

To understand how the performance of these stations affected the surrounding retail offering, we assessed the top 10 retail and leisure categories in close proximity to all GB train stations, analysing the rate of churn to see what percentage of occupiers in each category remained open at the end of 2022.

Near the stations which saw the greatest declines in passenger volumes, banks (56%) and fashion & general clothing (56%) had the lowest survival rates. Fashion & general clothing in these areas was particularly impacted by the decline of mens’ shirts and suit retailers, driven by severely reduced need from a lack of in-person office working, weddings and business trips. This was a primary factor in the closures of T.M. Lewin, Moss Bros and Pink stores.

Perhaps surprisingly, the entertainment category had some of the highest survival rates across both the top-performing (88%) and worst-performing (84%) transport areas, with the largest percentage of retailers in the bookmakers category. Despite closures in this subcategory across GB, bookmakers situated near transport hubs seem to have been resilient to these cuts, even with reduced footfall.

Figure 3: Survival rates across the top 10 retail categories across GB transport hubs, split by the best- and worst-performing stations (Source: Local Data Company)

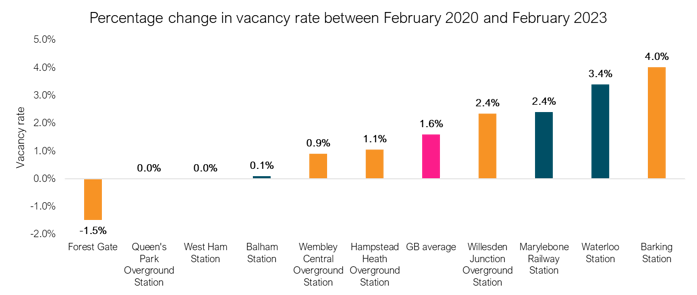

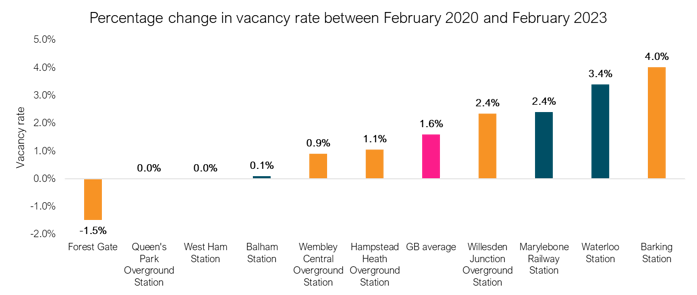

Of all locations in this analysis, the only station to see a fall in vacancy rate between February 2020 and 2023 was Forest Gate station (-1.5%). This is likely due to the opening of the Elizabeth Line in mid-2022, which has improved connectivity and boosted passenger numbers.

Balham station defied its reduction in passenger numbers: vacancy rates in the retail area surrounding the station only rose by 0.1% in the period, lower than the GB average increase. The area was boosted by remote working, and new openings from occupiers such as Soho House looking to take advantage of the increased weekday catchment.

Figure 4: Percentage change in vacancy rate across transport hubs between February 2020 and February 2023, compared to the GB average (Source: Local Data Company)

As indicated by the ORR data, transport hubs have seen a recovery in passengers after the challenges of the pandemic. However, many of the largest stations have not seen passenger volumes return to pre-pandemic levels yet, and, as remote working continues for some, stations may have to adapt their offering to suit a new baseline passenger level.

The recent transport strikes are, of course, not factored into these numbers, but they make it even less likely that pre-pandemic passenger volumes will return soon. Occupiers located in and around transport hubs may have to carefully consider their transport-adjacent stores, while landlords may turn their attention to areas that now have a stronger Monday-Friday population. Despite changes in footfall (that may be permanent to some degree), many categories have been able to remain resilient and use stores in new ways.

901

901

901

901