In the current climate, where rents are high and local markets are especially competitive, pop-ups and residencies allow brands to gain traction, test products and locations and generate revenue and investor interest. To understand the role of shorter-term occupancies in the F&B sector, we took a closer look at some of the brands who have made the most of markets, pop-ups and food halls.

A launchpad for independent food businesses

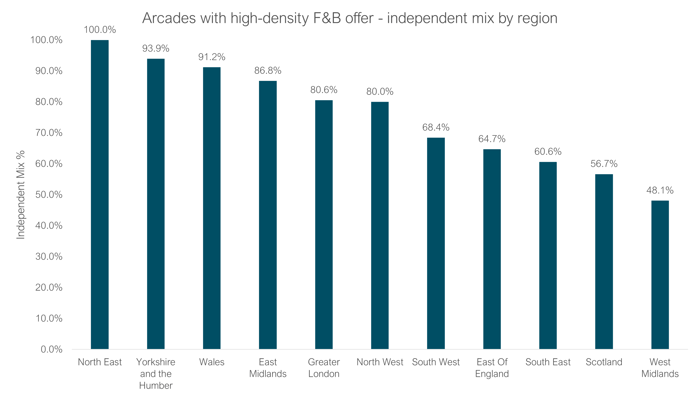

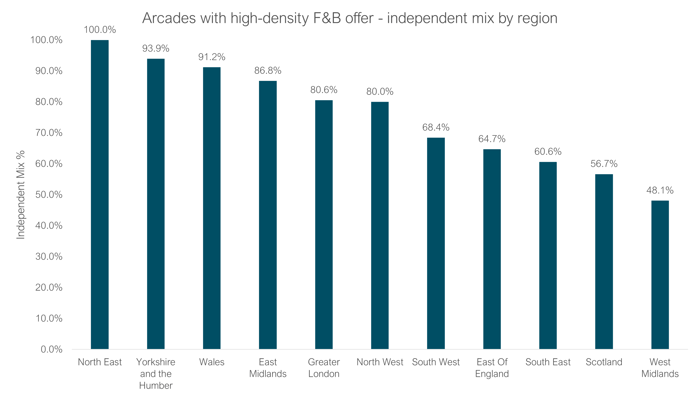

Across the 1,020 F&B-dominant arcades in GB, all regions have a higher mix of independent food brands compared to multiples, with the exception of the West Midlands. Of the 20 food-dominant arcades in the North East, 100% of food occupiers are independent, with Yorkshire and the Humber and Wales having similarly high proportions of independents. However long it remains there, taking up space at an F&B arcade or food hall can be a more accessible way for an emergent business to gain visibility and develop its identity, with a view to relocation or expansion in the long-term.

Figure 1: Independent mix by region at GB arcades with high-density F&B offer (Source: Local Data Company)

Brand success stories

Launching in an F&B marketplace can work incredibly well— several hospitality success stories have their beginnings in temporary spaces. Many food brands first launched as a pop-up and have since expanded into permanent sites. Examples include Homeslice: starting at markets and festivals, the pizza brand followed its 2011 residency at London’s Kings Cross Filling Station with a permanent opening in Neal’s Yard two years later. As of June 2023, it operates 3 sites in the city.

Some brands have found success through modern supper clubs, which have allowed chefs to make use of under-utilised kitchens in local pubs and unusual venues. Som Saa and Breddos & Tacos both started in this way and now operate permanent sites in London.

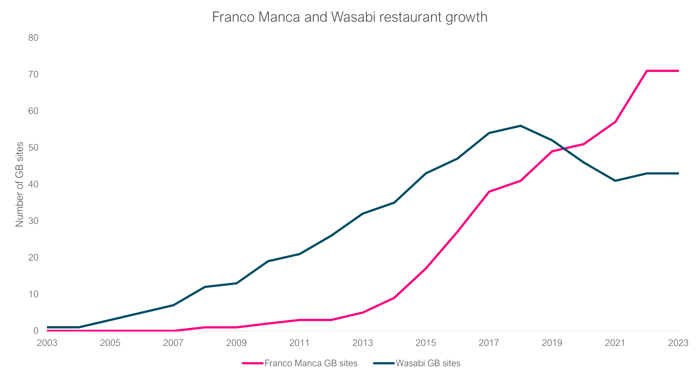

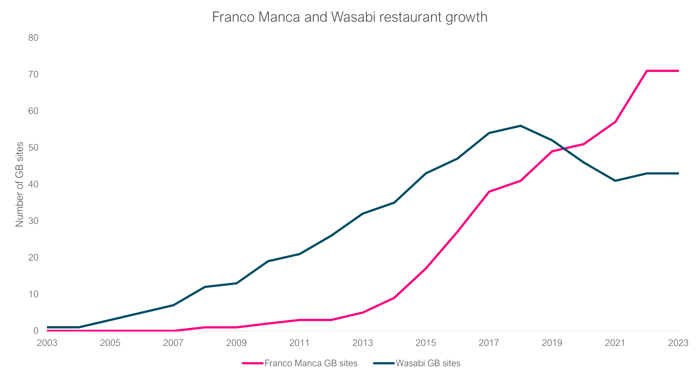

Franco Manca and Wasabi both launched at markets and are now well-established national brands whose respective estates continue to grow year-on-year. Franco Manca saw its largest increase in restaurants during 2022, following an initial growth spurt in 2016 and 2017. Parent company Fulham Shore, who also own The Real Greek, emerged from the challenges of the pandemic to post strong revenue figures last year. As with Franco Manca, 2022 saw a return to growth for Wasabi, with plans to increase its estate in the years to come.

Figure 2: Growth in GB sites for Franco Manca and Wasabi, 2003-2023 (Source: Local Data Company)

The hospitality sector was hit especially hard by the pandemic, and economic headwinds continue to bite in 2023. A residency at a dedicated food-dominant location, such as an arcade or pop-up space, can help a brand be seen without costly long-term lease commitments.

Of course, other retail and leisure subsectors have made use of short-term space: we have seen charity shops, galleries and social media make creative entries into the pop-up space, to name a few examples. As we continue to redefine physical retail and leisure space, short-term spaces serve as a playground for experimentation, allowing brands and customers to shape the locations of the future.

901

901

901

901