In recent years, the FMCG and convenience industries have weathered the pandemic-driven upheaval— and even seized on the opportunities it presented. In this blog, we delve into some of the key trends in the GB convenience sector using our vast historical data and in-depth analysis. These trends not only highlight the resilience of the sector, but also provide valuable insights for businesses looking to thrive in the current environment.

Surviving— and thriving

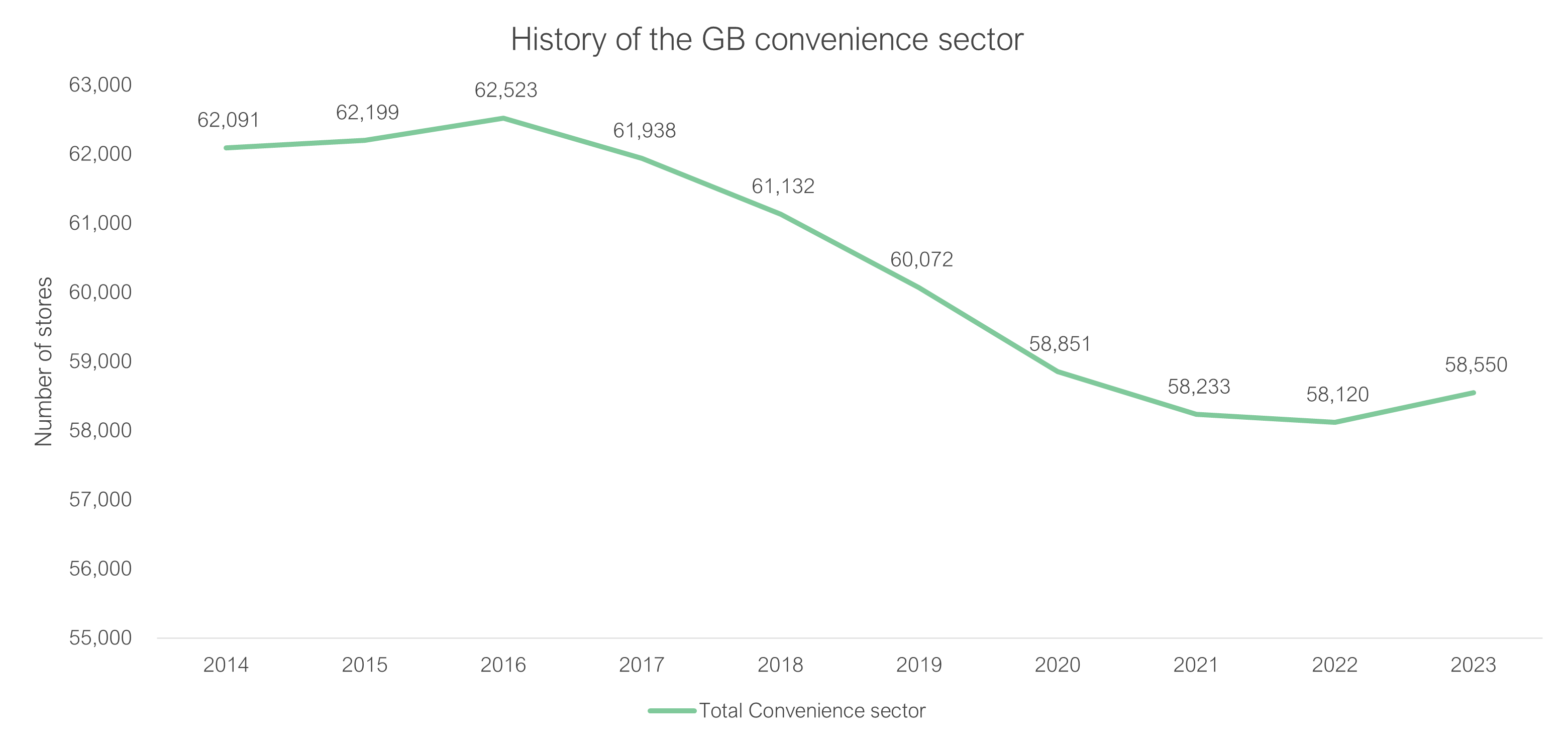

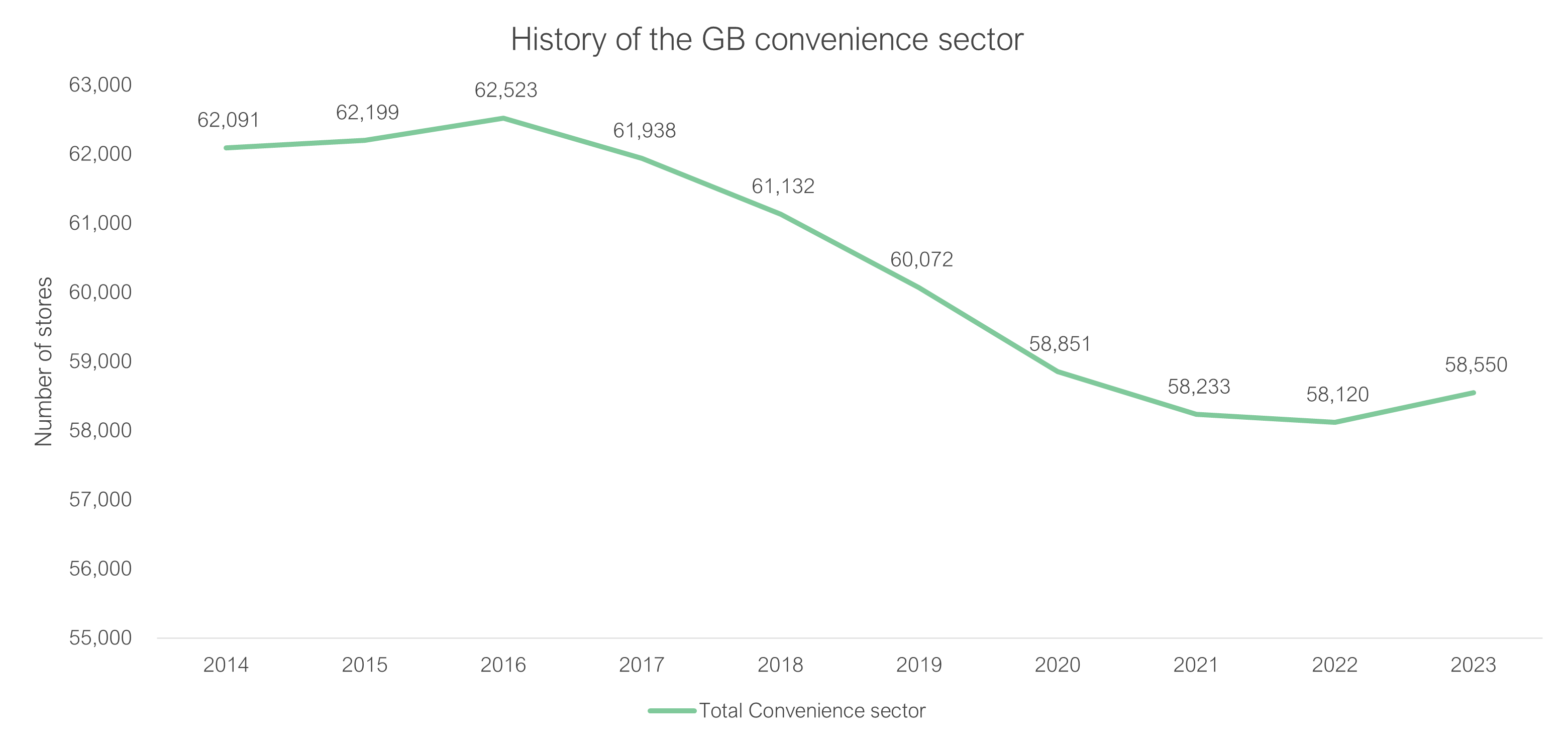

2023 saw a significant uptick in convenience retail growth across GB. This was due to, among other factors, evolving technologies and changes in consumer behaviour. Local convenience outlets have benefitted from localisation— necessary during lockdowns but persisting in popularity— as shoppers continue to favour ‘shopping local’ and making more frequent convenience shopping trips.

Figure 1: Total convenience units across GB, 2014-2023 (Source: Local Data Company)

There has been a substantial rise in small-format convenience stores, and larger retailers have recognised the potential in expanding into smaller independent stores. These smaller stores are strategically positioned within easy reach of residential areas, enabling them to capture spend from home workers. A prime example of this trend is Morrisons’ wholesale model, ‘Together with Morrisons’, an initiative catering to independent supermarkets of 3,000sq. ft. and larger. Under the initiative, retailers have more freedom to select the range of products they stock, in line with the needs and preferences of their local catchment. The result is a win-win situation, benefitting both the businesses and the communities they serve.

Long-term survival

The convenience sector has seen notable growth in the number of retail units that have survived to their third-year anniversary. This reflects the opportunities available for businesses in this sector, and the potential for success for those who can navigate the market effectively.

Of course, the sector is not without its challenges. One of the key threats to survival has been the accelerated shift to online shopping— lockdown restrictions in 2020 reduced footfall to physical stores, forcing some to close their doors. Despite this, 2022 saw the highest number of retailers reaching their third anniversary, thanks to government support packages, business rates relief and agile businesses adopting innovative shopping concepts.

Independent convenience retail has experienced significant year-on-year growth in survival rates; this dipped only slightly in 2021, with a growth of 61.6%. The growing trend of consumers shopping and supporting locally has played a pivotal role in this success. Independent businesses have reaped the benefits of this trend, demonstrating the immense opportunity for independents in the convenience sector.

Business types and net change

Over the past ten years, independent convenience stores have experienced fewer closures compared to multiples, excluding 2018. Independent businesses saw a net change of +1,242 units in 2021, a remarkable increase driven by the growing demand for stores as consumers began to shop locally more frequently. In contrast, multiples have seen the gap between openings and closures narrow since 2021, largely due to the expansion of supermarket and symbol group estates. This indicates a shift in consumer behaviour and preferences, with the convenience sector continuing to adapt to these changes.

Room for growth

‘Big 5’ chain supermarkets and symbol group convenience stores have been growing gradually over the past decade. Since 2014, symbol groups in the convenience sector have grown by 27.1%, representing a significant rise. Continued growth shows that there are still opportunities for new and existing convenience businesses.

The convenience sector has demonstrated remarkable resilience, adaptability, and growth despite a challenging retail climate. Our in-depth analysis and historical insights enable us to offer specialist support to FMCG and convenience businesses looking to navigate these trends. To discuss how we can support your strategic business objectives and future planning, contact us at team@localdatacompany.com.

-3.jpg)

901

901

901

901