Edge Analytics’ housing development dataset integrates seamlessly with LDC’s up-to-date intelligence on the retail and leisure sector, offering a comprehensive view of supply and demand across micro- and macro- geographies. In this case study, we combine Edge and LDC datasets to identify catchments which are underserved in terms of grocery retail provision across Greater Manchester.

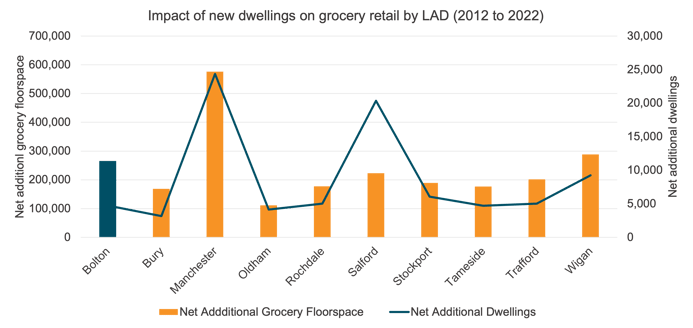

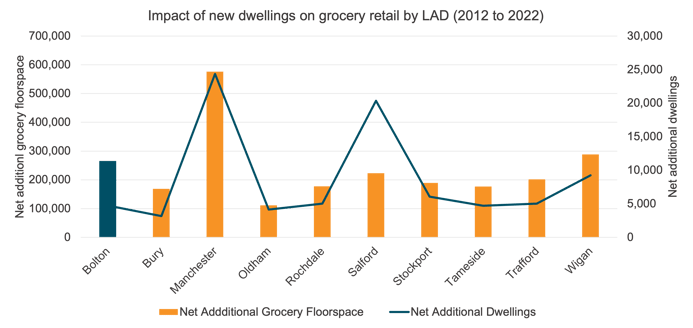

Figure 1: Impact of new dwellings on grocery retail by LAD (Source: Local Data Company)

According to our analysis of Greater Manchester, Manchester City Centre has seen the largest increase in housing over the last 10 years, with the addition of nearly 600,000 new homes. This has also influenced the addition of nearly 25,000sq. ft. of grocery retail over the 10-year period.

Salford (11), Manchester (24) and Oldham (27) all saw a below-average addition of grocery retail in comparison to new dwellings over the 10-year period. Salford was the main outlier; the LAD had an undersupply of grocery retail in comparison to other Greater Manchester local authorities, stemming from a prior lack of investment or interest from existing grocery retailers. However, the growing number of new developments presents an opportunity for supermarkets and convenience stores to target Salford and cater to new residents.

Figure 2: Additional net new dwellings per net grocery retail (Source: Local Data Company)

Figure 2: Additional net new dwellings per net grocery retail (Source: Local Data Company)

Net additional dwellings in Manchester City Centre have been rising year-on-year, with the number of net dwellings added to the market in 2021/22 over four times larger than in 2011/12. This figure did dip in 2021/22 as work stopped due to lockdowns. This time lag is expected to impact the next three years, following the delayed pipeline of completions in the market from 2020 and 2021. Demand for new homes has been strong across the local authority area, with average house prices rising 173% across the 10-year period from £126,000 in 2011 to £216,000 in 2022.

Figure 3: Net additional dwellings over the last 10 years, Manchester Local Authority District (Source: Local Data Company)

Figure 3: Net additional dwellings over the last 10 years, Manchester Local Authority District (Source: Local Data Company)

The map below shows all fully-approved projects set to add at least 200 homes each within the next five years across Manchester City Centre. This produced a list of 23 developments that will deliver a total of 9,918 housing units before 2027.

.png?width=600&height=482&name=MicrosoftTeams-image%20(47).png)

Figure 4: Map of new housing developments across Manchester (Source: Edge Analytics)

The largest development in the city centre is the Downing Living scheme to the south of Manchester Oxford Road station, set to deliver 1,236 apartments, comprising over 2,000 bedrooms, by 2027. The proposed scheme will have a diverse mix of residents, offering studios catered to local students from the nearby Manchester Metropolitan University and five-bedroom apartments suited to family living. The development will also add a 3,000 sq. ft. café and 14,000 sq. ft. gym, both open to the public. This offers the potential for grocery retailers to cater to the needs of the sizeable, diverse catchment set to populate the area.

By comparing the growth rates of grocery and housing sectors across local authorities, we have identified areas that are potentially underserved in terms of grocery provision.

The analysis reveals significant opportunities for grocery retailers in Salford, which have had a below-average growth in grocery retail compared to the number of new dwellings in the area. Given the strong demand for new homes in Salford and its surrounding areas, supermarkets and convenience stores could target this area, focusing around the new developments.

We have also identified opportunities in the city centre, where a large number of new developments are expected to complete in the next few years. Projects such as the Downing Living development are set to add thousands of residents to the area, causing a swell in demand for grocery retail.

Understanding the dynamics between housing and grocery sectors can build a picture of future demand across a given location, helping to identify the strongest opportunities for retailers and supporting sustainable, profitable expansion activity that meets the needs of local communities.

For more information on our capabilities in this space, please contact team@localdatacompany.com.

901

901

901

901

Figure 2: Additional net new dwellings per net grocery retail (Source: Local Data Company)

Figure 2: Additional net new dwellings per net grocery retail (Source: Local Data Company) Figure 3: Net additional dwellings over the last 10 years, Manchester Local Authority District (Source: Local Data Company)

Figure 3: Net additional dwellings over the last 10 years, Manchester Local Authority District (Source: Local Data Company).png?width=600&height=482&name=MicrosoftTeams-image%20(47).png)