Fable Data is an Alt data provider which uses anonymised transaction data from banks, credit card providers and fintech companies to deliver insight used by investors for decision making and strategic planning. Their mission is to aggregate ethically sourced, real-time data on the consumer economy, supporting their hedge-fund clients to adopt data-driven strategies and find investment ‘signals’ in the market.

THE CHALLENGE: MATCHING TRANSACTION STRINGS TO MERCHANTS

Fable Data approached the Local Data Company as they required high-quality, robust and legitimate data to validate merchant information against transaction data which can often be difficult code to crack. Merchant transaction strings (the information on each transaction on bank or card statements) can be a series of letters and numbers and can vary widely across each brand or vendor.

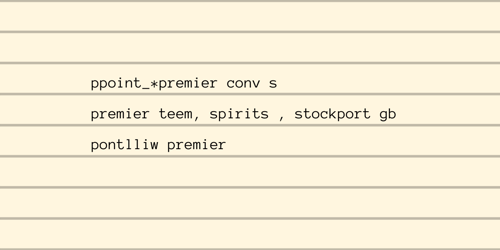

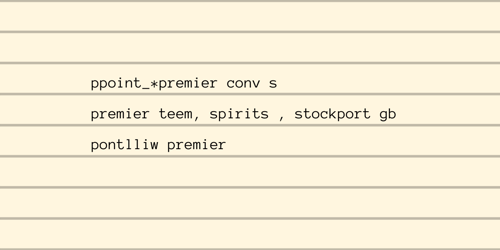

Examples of transaction data strings for a Premier convenience store (Source: Fabledata.com)

In order to match transactions to vendors, Fable Data required comprehensive data on all the merchants trading in the UK including lists of stores for brands. Avoiding web-scraped data was important in order to protect the integrity, reliability and accuracy of their insight product. Fable Data uses Local Data Company records to match transaction strings against known merchants to build what is known as a ‘training set’ which helps analysts identify a list of transaction strings that are a true match for a vendor, including all sites across a store estate. This work also helps Fable to determine whether spending was within retail stores, cashback services, at ATMs or online and helps them to reduce the prevalence of ‘false positives’ for transactions.

Matching against Local Data Company data on 5,000 multiple brands, Fable Data has been able to match transaction strings to vendors and organise volumes of spending into retail categories such as grocery, clothing and home & garden, boosting the insight available from the transaction data. This data forms a critical part of Fable Data’s offer and provides relevant, impactful and timely evidence for hedge funds making investment decisions.

COVID-19 MARKET RECOVERY TRACKING

During the COVID-19 pandemic, Fable Data was able to provide real-time evidence on the recovery of the consumer economy in the UK, using the powerful combination of Local Data Company data and transaction data. They measured the daily, weekly and monthly recovery of different corners of the market to evidence the real-time trends as they happened. The data was so strong it was featured in the Financial Times eight times within a two-month period as an indication of the speed of recovery following lockdown.

“We needed reliable reference data on all the shops trading in the UK. LDC gave us the names of the businesses operating in the country, including those that had gone bust during the historical time period that the Fable Data panel covers. Fable used the LDC file to seed our search for merchant names within our anonymised transaction data. We now have data set with millions of rows, covering thousands of merchants use to train and tune neural networks and support vector machines that identify merchants in consumer spend data for our clients. LDC saved us time and also helps us to identify the names of new merchants that start to trade and grow their store estate.”

- Mark Howland, Chief Data Scientist

901

901

901

901