Contacts

Local Data Company

Lucy Stainton

Commercial Director, Local Data Company

press@localdatacompany.com

07889591487

Retail market activity spikes amid economic challenges

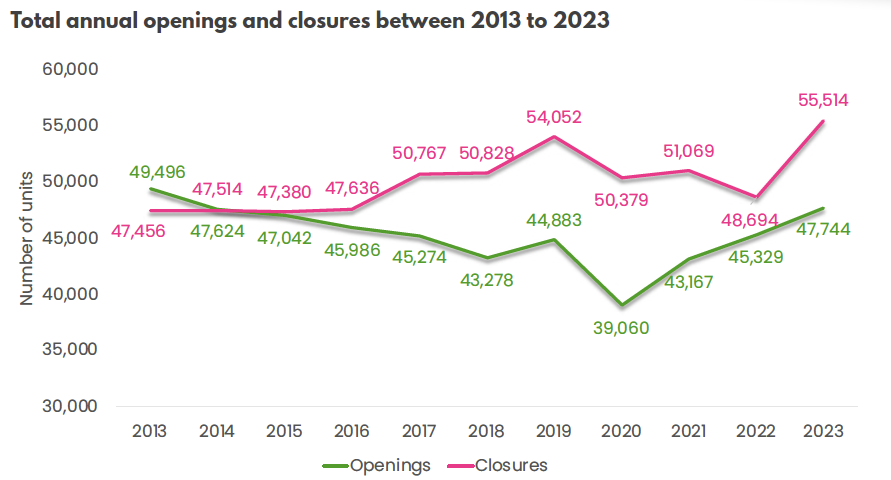

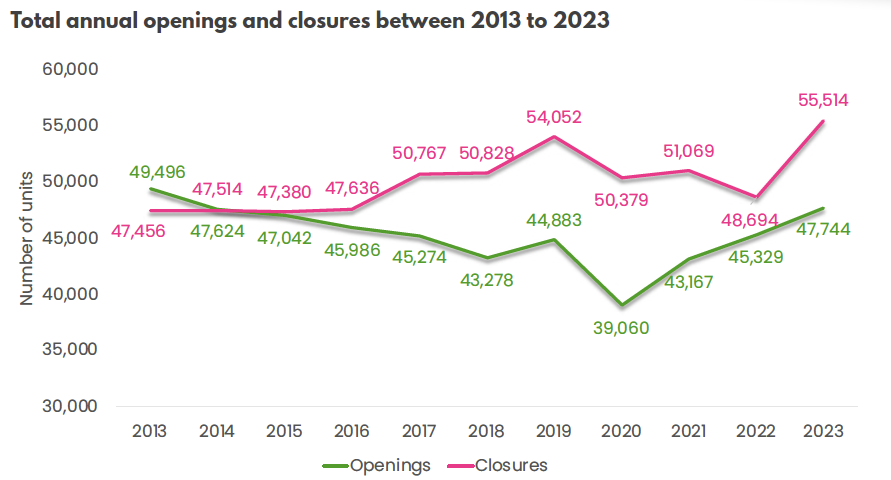

New retail and leisure research has revealed a boom in commercial real estate activity over 2023. The latest report by the Local Data Company and Green Street, covering key developments across the entire GB retail and leisure market over 2023, shows a spike in numbers of both closures and openings, representing significant churn. The overall data picture demonstrates the resilience and flexibility of GB retailers and leisure operators in the face of widespread economic difficulty, with clear opportunities emerging for businesses and landlords.

Rises in interest rates and operational costs compounded the challenges for GB retailers, leading to a year-on-year increase in closures of 14% between 2022 and 2023. However, closures were somewhat tempered by a 5% rise in openings during the same period, indicating a much more resilient and adaptable market than has been seen in previous years. Innovative changes of use and retail-to-residential conversions have become increasingly attractive, offering an economically viable option to address vacancies, align locations with current demand and revitalise town centres.

Figure 1: Historical openings and closures across GB, 2013 – 2023 (Source: Local Data Company)

Retail parks were a particular area of strength, continuing the positive trajectory they have seen in recent years. With a net increase in units of 0.4% over 2023, they were the only location type to see a positive overall change. Demand remained high for retail park units, driving a 1.4% year-on-year decrease in vacancy rate. Further decreases are expected as retailers continue to expand their out-of-town offer, with investors in this space projected to see some rental growth.

While competition from out-of-town retail drove a 1.3% decrease in units for shopping centres, vacancy did improve by 0.5%, reflecting continued efforts to attract occupiers following the pandemic as well as convert long term vacant space into other uses. Analysis by Green Street reveals that strong, experience-led tenant mix is the key to thriving shopping centres; accordingly, for many retailers in this sector, the focus has been on creating immersive in-store experiences and prioritising highly-visible prime locations.

Barbers, nail salons and beauty salons were among the fastest-growing categories in 2023, reflecting sustained demand for personal grooming services. Convenience stores also continued to expand, with c-store formats ideally positioned to cater to cost of living-influenced shopping trends for more frequent trips and smaller basket sizes. Green Street predicts that community provision will continue to be a major theme in local retail strategy, with mixed-use development projects becoming easier to realise following changes to UK planning regulations.

Despite the economic headwinds seen over 2023, the latest data indicates a notable level of resilience across GB retail and leisure. While inflation and interest rates ease, making space for growth, uncertainty is still present in the form of anticipated economic and political change. Green Street and LDC anticipate that flexibility and careful strategy will enable agile retailers and developers to navigate any upcoming challenges and identify opportunities.

Comment from Lucy Stainton, Commercial Director, Local Data Company:

2023 was a period of significant volatility and churn, with activity across the market in terms of openings and closures far beyond anything we’ve seen in the previous couple of years. Whilst the spike in closures can’t be ignored, the fact this sits alongside increased levels of new store openings, seems to indicate operators are continuing to restructure and repurpose their portfolios rather than a terminal market decline. The sectors most affected by closures all point to the continuing impact of higher energy prices in ‘23, such as pubs and hairdressers and a change in demand for more digital led services such as with the banks and estate agents. As we look forward across 2024, we expect to see such high levels of churn temper, as many large operators come towards the end of any material rationalisation programmes, as well as greater economic certainty in some aspects, given a level of recovery in energy prices and inflation.

ENDS

The full report will include further detail on:

- Openings and closures

- Vacancy rates

- Multiple vs independent performance

- Growing and declining retail and leisure categories

- Central London’s office hotspots

- Long-term vacancy rates

- Reoccupation of ex-Arcadia sites and department stores

- The potential for repurposing and repositioning retail assets, including via retail-to-residential conversion

For more information, please see www.localdatacompany.com.

901

901

901

901