Earlier this year The Body Shop, announced that it had gone into administration, with the likelihood of mass store closures. At the time of writing 7 stores had already been closed, with more expected over the coming days and months. This blog delves deeper into The Body Shop’s physical store portfolio, sizing up the estate to see the opportunities for potential occupiers, the impact on competitors, and which locations will be most affected across GB.

Store Portfolio

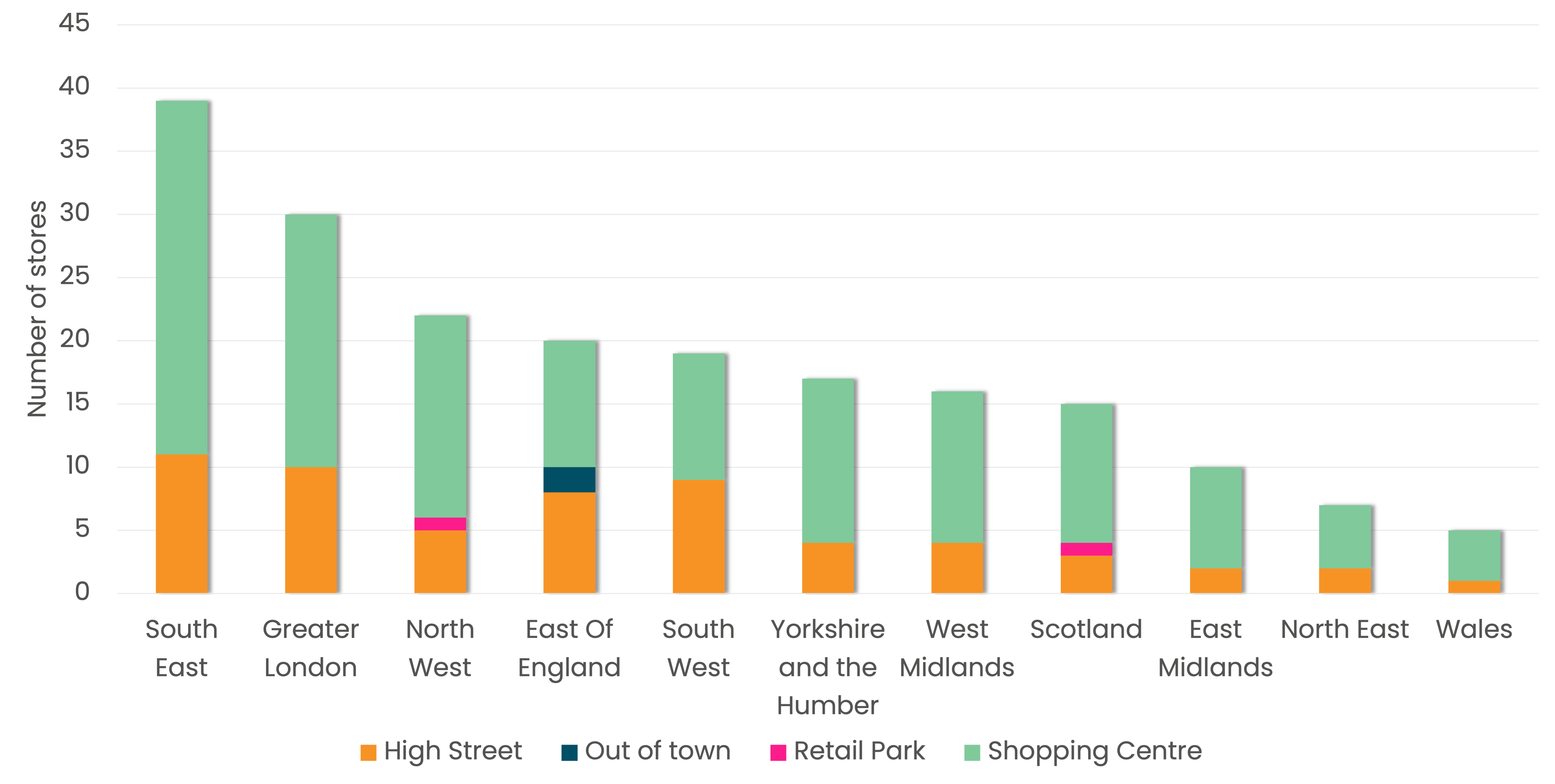

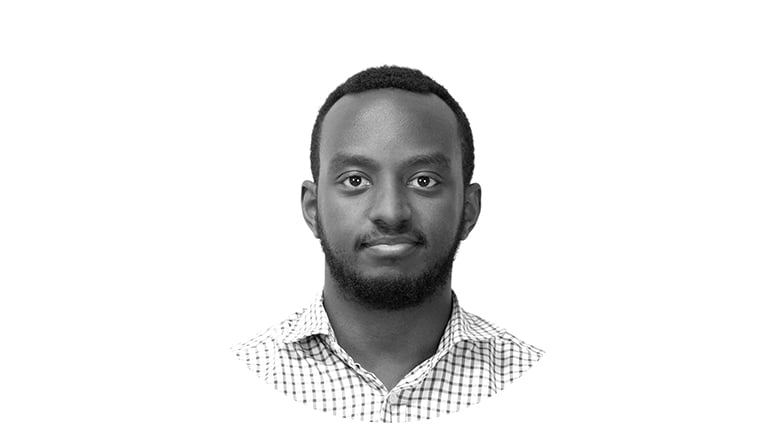

Number of The Body Shop stores by region and location type across GB (2024)

Figure 1: Number of The Body Shop by region and location type, February 2024 (Source: The Local Data Company)

The Body Shop portfolio had a total of 200 stores at the start of February, with 69% of these stores within shopping centres. The Body Shop had 30% of its stores on high streets, with only 2% of stores in out-of-town locations and retail parks. The South East had the most stores with 39 stores across the region. Greater London (30), North West (22) and East of England (20) were the other regions to have a significant brand presence. The North West will be the hardest hit of these regions, due to the vacancy rate across North West shopping centres being one of the highest across the whole country at 19.5%, compared to just 14.1% in the South East and 14.5% across Greater London. These shopping centres already have unoccupied units, so the threat of more closures will put pressure on landlords. The least affected regions were Wales (5 stores) and the North East (7 stores). This is good news for these two regions given they currently have the highest vacancy rates across all the regions, as recently published in our latest LDC Vacancy Monitor.

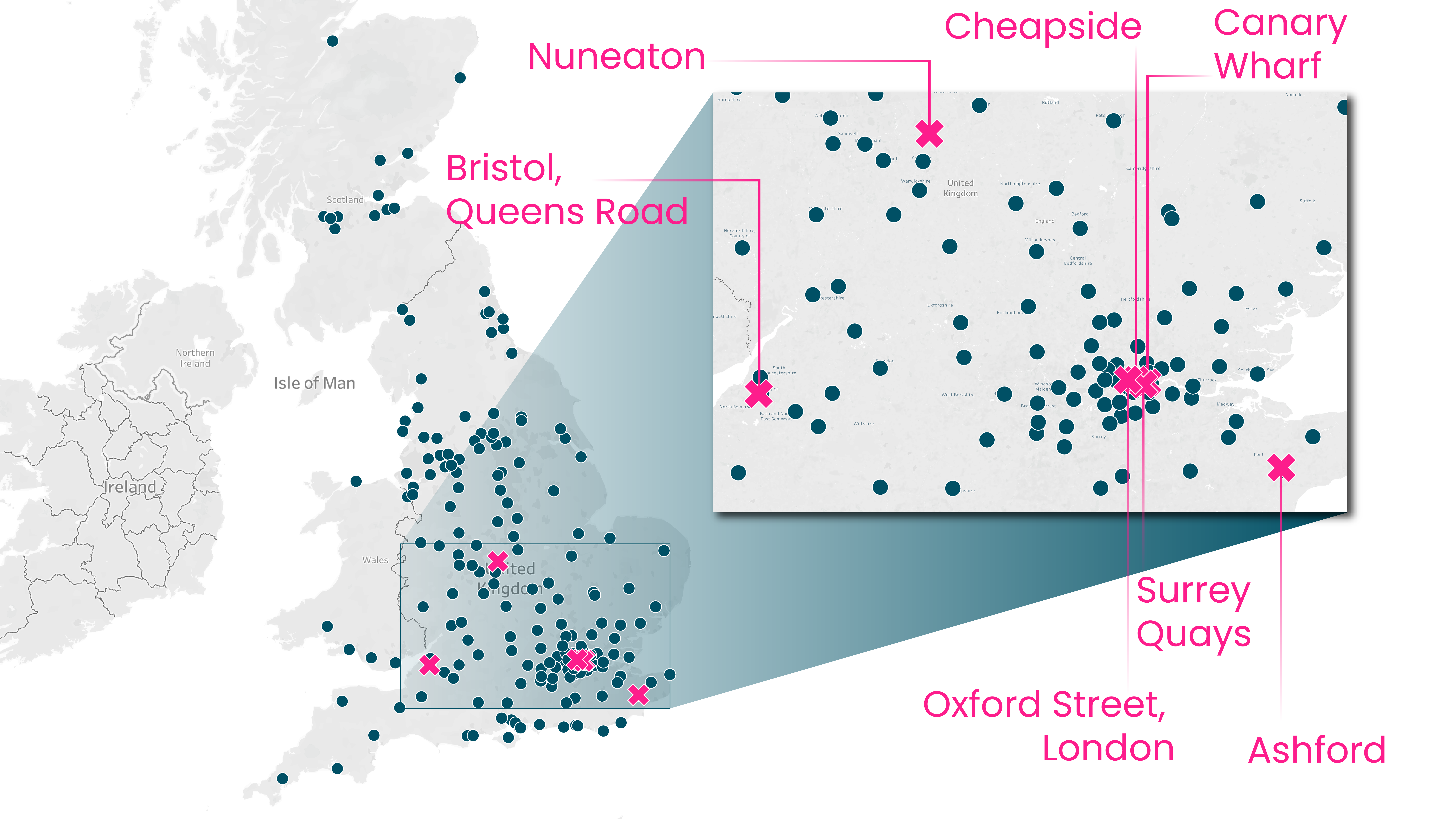

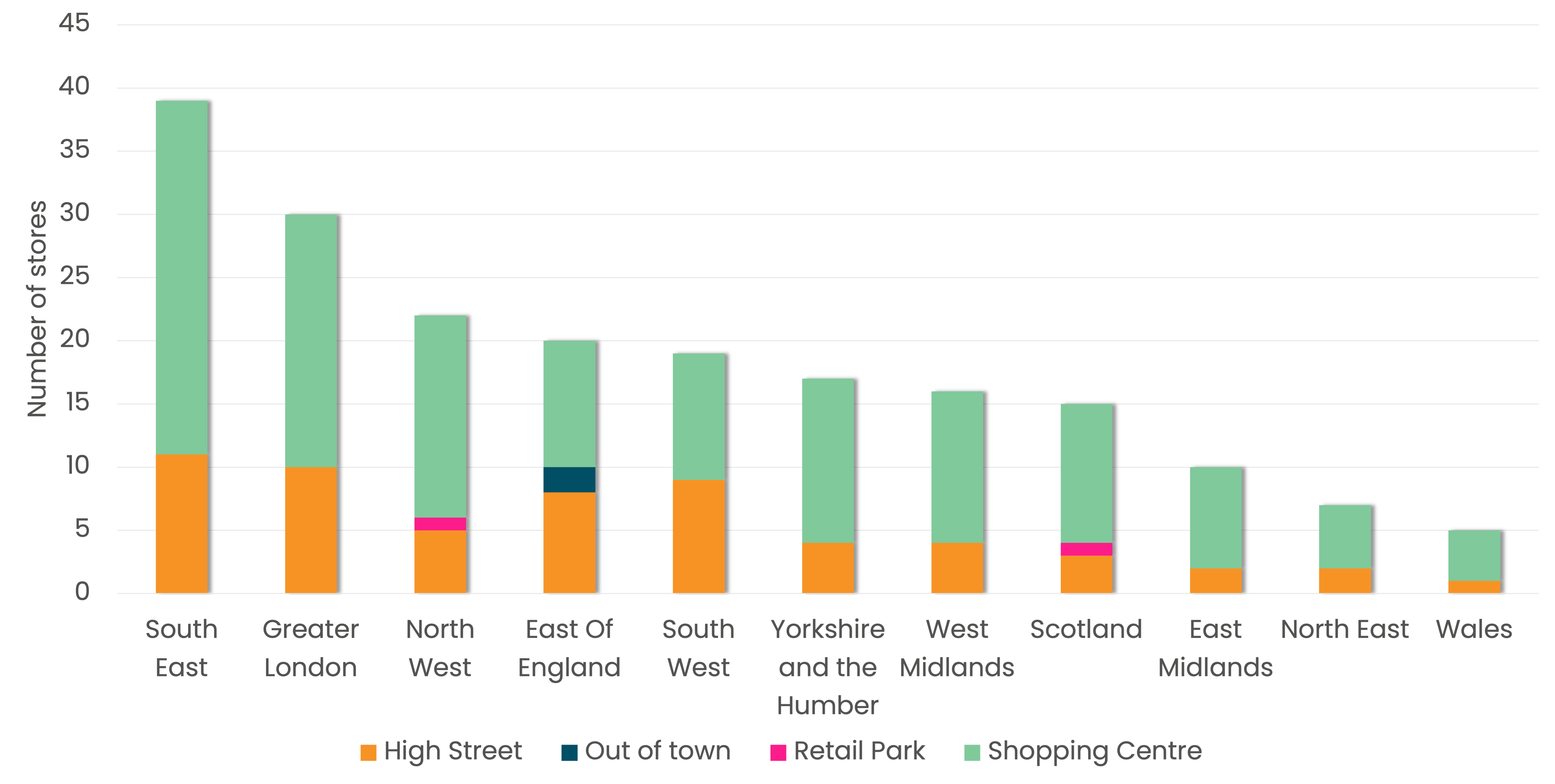

Figure 2: Map showing The Body Shop locations and confirmed closures across GB (Source: Local Data Company)

Portfolio Health

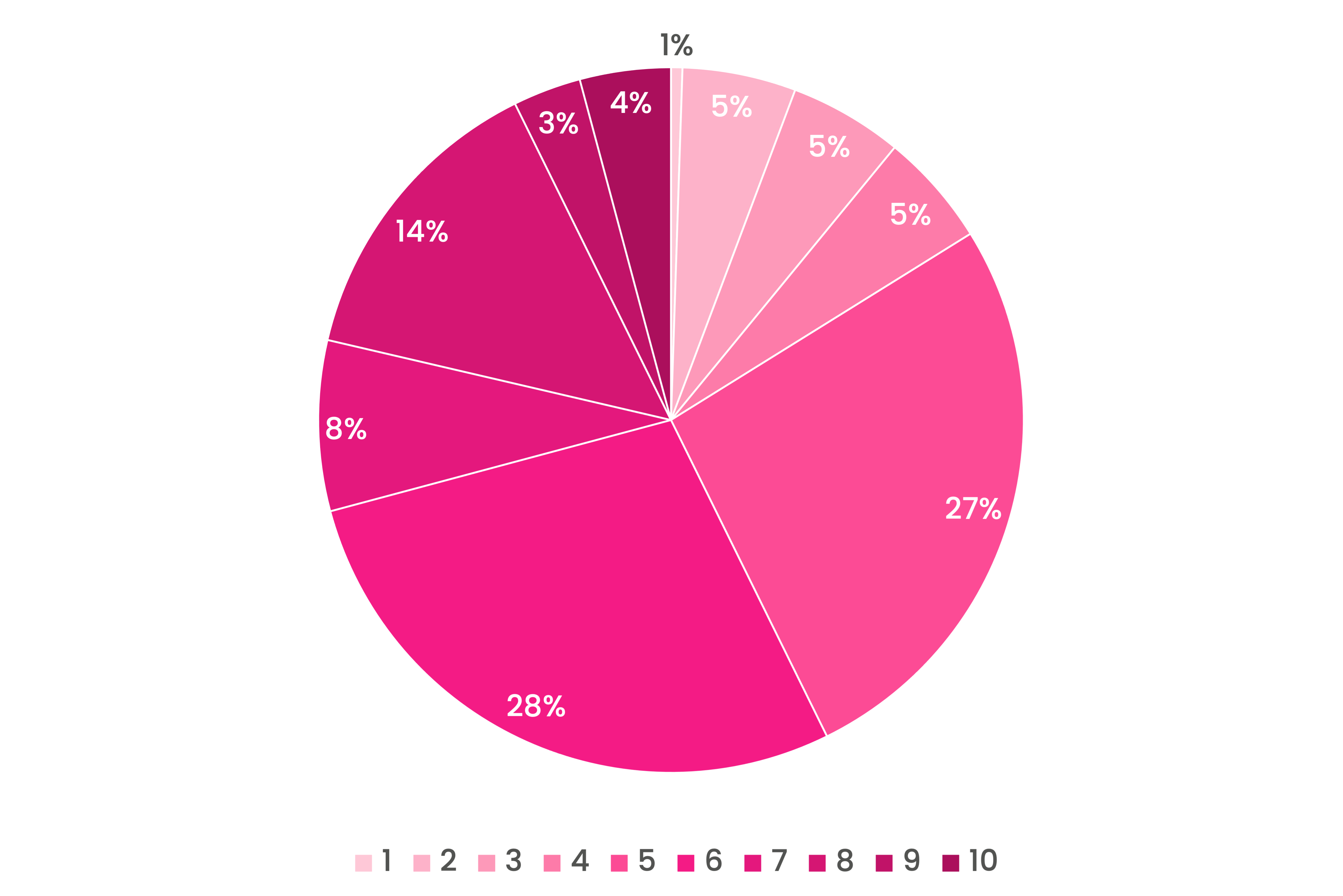

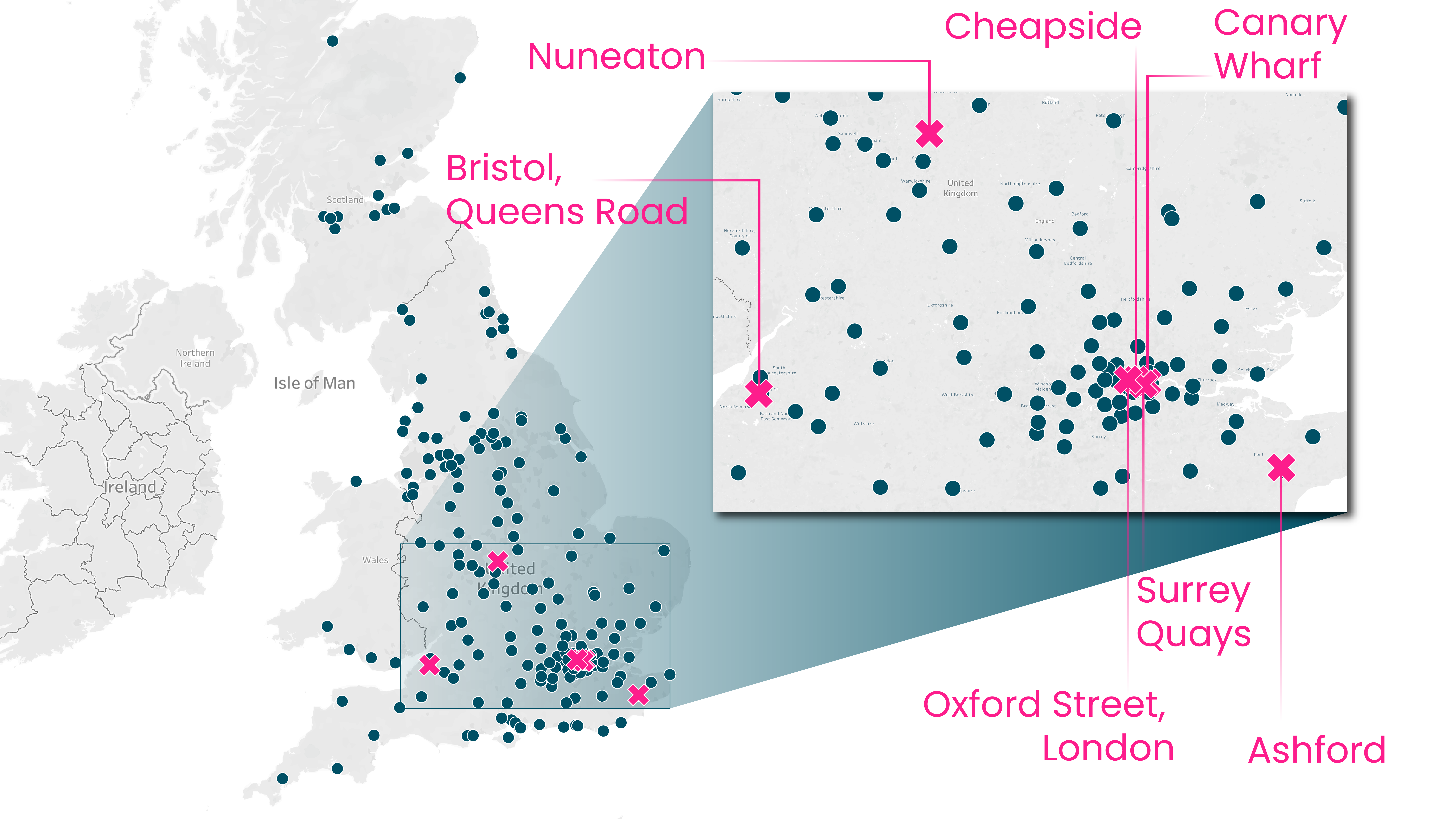

LDC’s proprietary LDC Health Index measures the retail attractiveness of locations across GB based on occupation, tenant mix, catchment size, dwell time and demographics. The LDC Health Index rating for The Body Shop portfolio shows that their stores were in strong locations with 57% of their existing store network in locations rated 7/10 or better. Only 11% of their stores were in locations with a rating of 3/10 or less. This data shows that landlords will likely find it easier to relet units, with the collapse of the business more aligned to a broader range of challenges such as increased competition both physical and online, a lack of a digital presence and heavy discounting during the festive period – rather than the fundamental strength of the locations they were in.

LDC Health Index rating for The Body Shop portfolio

Figure 3: LDC Health Index rating for The Body Shop portfolio across GB (Source: Local Data Company)

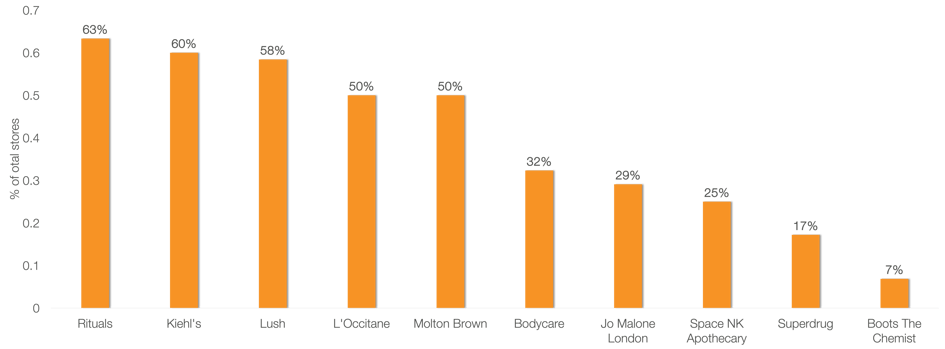

Competition Density

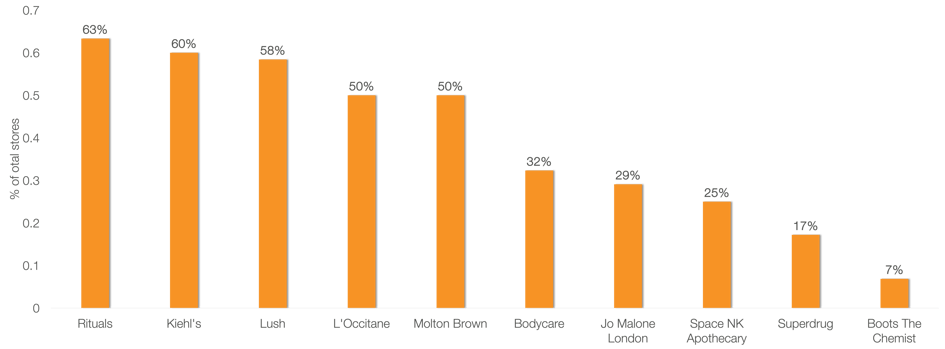

LDC analysed the competition around The Body Shop stores to identify health and beauty brands that are likely to see an uplift in sales based on their proximity to potential stores set to close. Lush had the highest number of stores within 200m of The Body Shop, with the brand likely to capture more market share within the health and beauty category, especially due to their similar market placement within the ethical and sustainable segment. Lush has 59 stores within a 200m radius, with 16 of these on the high street and 41 across shopping centres. The chart below shows the large overlap in stores across a large percentage of competitors, indicating many would have already been taking spend away from The Body Shop prior to their collapse. Rituals have the largest percentage of their stores within a 200m radius with 63% of their stores within a 200m radius of a Body Shop store, with Lush (58%) and L’Occtaine (50%) the other key competitors with a large overlap of stores.

Percentage of portfolio within a 200m radius of The Body Shop

Figure 4: Percentage of competitor stores within a 200m radius of The Body Shop store, February 2024 (Source: Local Data Company)

Potential New Occupiers

The next phase for landlords will be to draw up plans for the scenario in which The Body Shop decided to exit their assets, on which occupiers to proactively target. LDC curated a list of potential new occupiers for The Body Shop stores based on a set of evaluation criteria to determine the most likely brands to target. The key factors considered were:

- Occupiers whose existing stores match the floorspace profile/requirements of The Body Shop stores.

- Brands that have had a positive net change (openings minus closures) in units across both shopping centres and high streets.

- Historical reoccupation of former The Body Shop stores that have closed in the last five years.

- Brands in categories that would fit the tenant mix of the assets that The Body Shop occupied.

- Brands that would not only match but boost the customer profile and quality of offer at the asset.

In total 16 target occupiers were pre-selected for the tenant target list with the size of the bubble indicating scale of net growth in units over the last 12 months.

.png?width=532&height=532&name=Body%20shop%20(2).png) Figure 5: Target occupiers for The Body Shop store locations, numbers in brackets show their portfolio size (Source: Local Data Company)

Figure 5: Target occupiers for The Body Shop store locations, numbers in brackets show their portfolio size (Source: Local Data Company)

Stay informed about the shifting landscape of the retail market and seize the opportunities it presents. Reach out to our team at Green Street and LDC to explore how our data-driven insights can guide your strategic decisions and drive success in this evolving retail environment.

901

901

901

901

.png?width=532&height=532&name=Body%20shop%20(2).png) Figure 5: Target occupiers for The Body Shop store locations, numbers in brackets show their portfolio size (Source: Local Data Company)

Figure 5: Target occupiers for The Body Shop store locations, numbers in brackets show their portfolio size (Source: Local Data Company)