The 1st of April this year saw new business rates revaluations come into effect, with the transitional relief scheme offering a cap on increases. High business rates have been cited as a key factor in may retail administrations and CVAs in the recent past, with steep rises in rates impacting profitability and favouring online-based competitors who are exempt from this burden.

We analysed 110 high streets over 94 towns in England and Wales, focusing on the presence of the fashion & general clothing category, to assess the impact of business rates changes on occupiers. This category has been selected as it has seen a net loss of 5,927 units over the last five years (2018-2023), more than any other retail category.

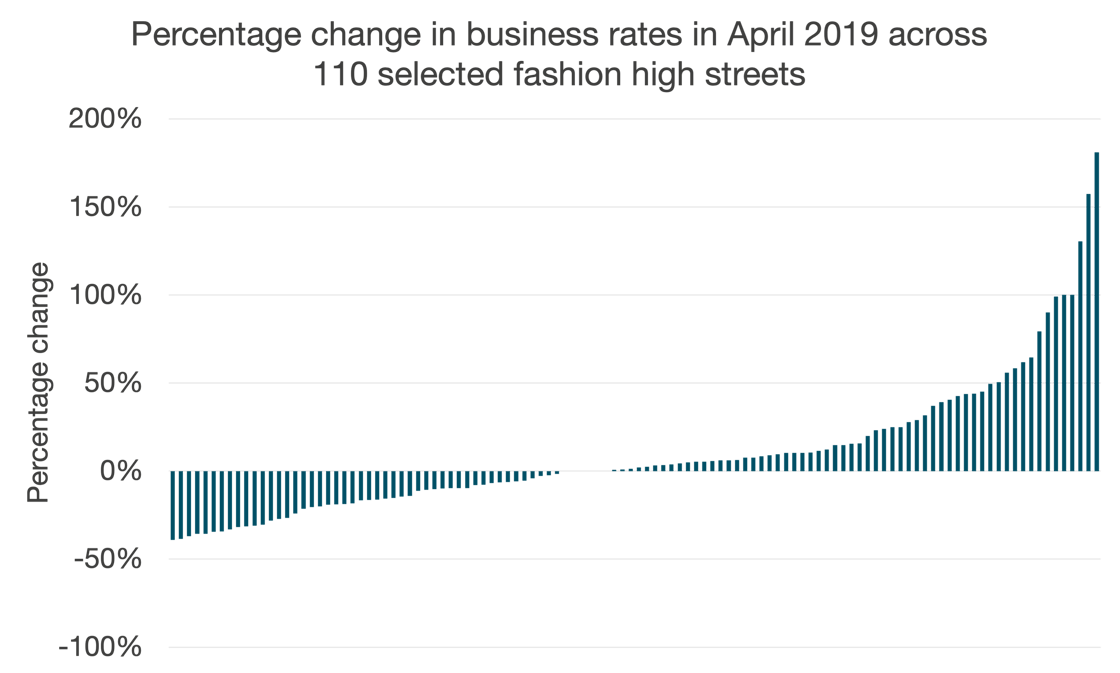

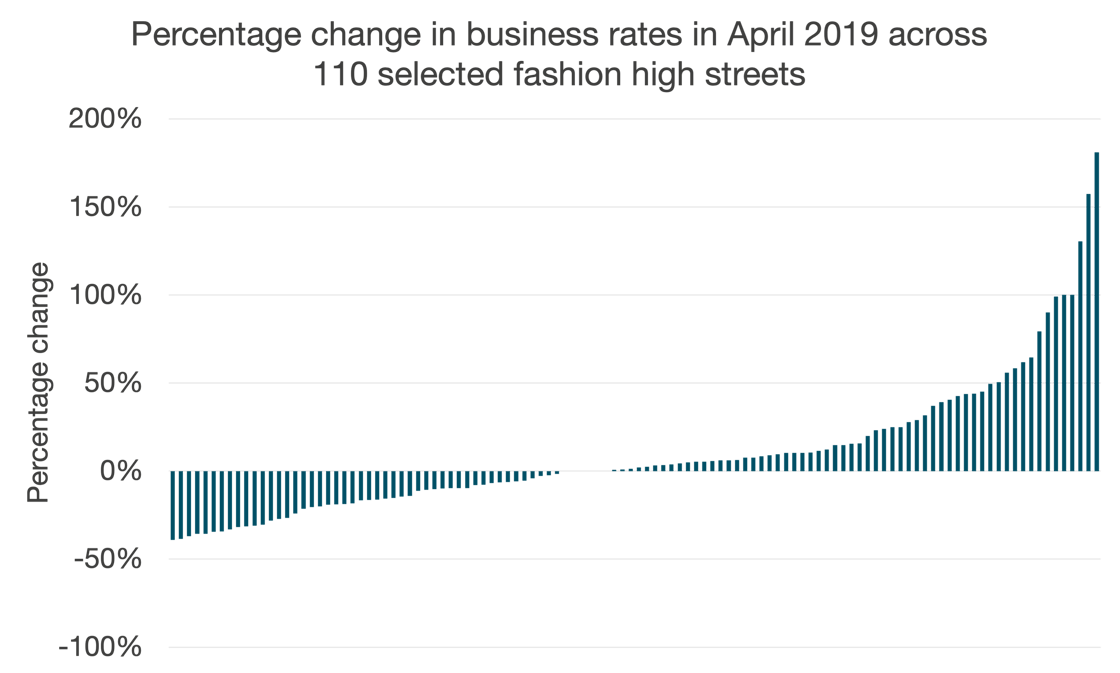

Figure 1: Percentage change in business rates across selected fashion-dominant high streets in England and Wales – April 2019 (Source: Local Data Company/VOA)

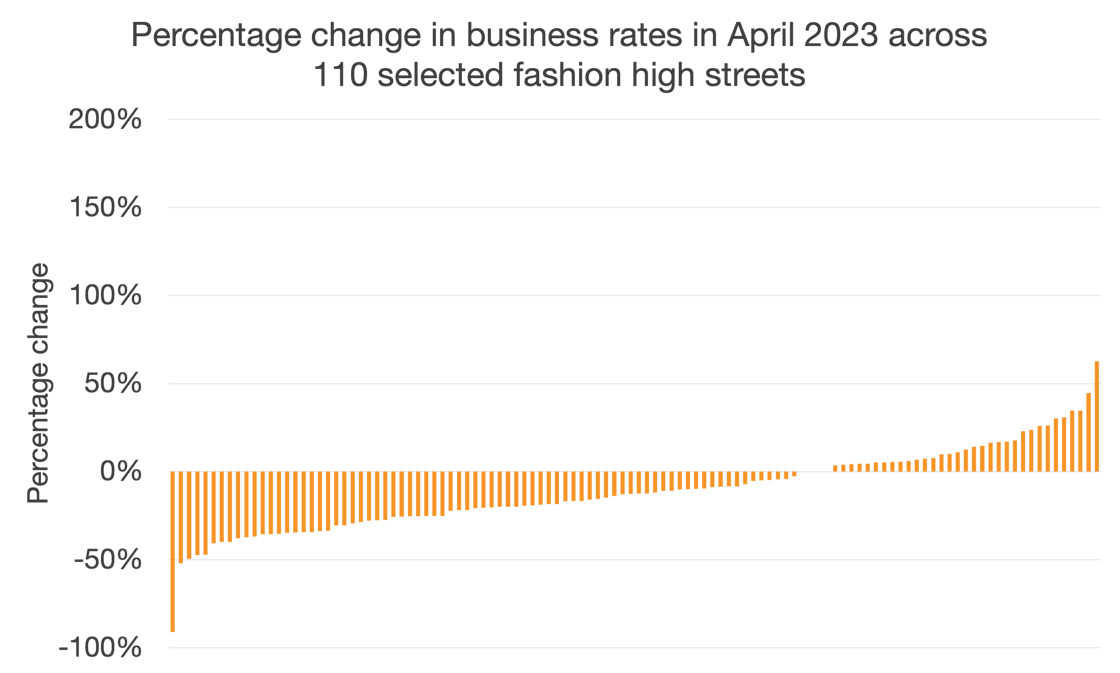

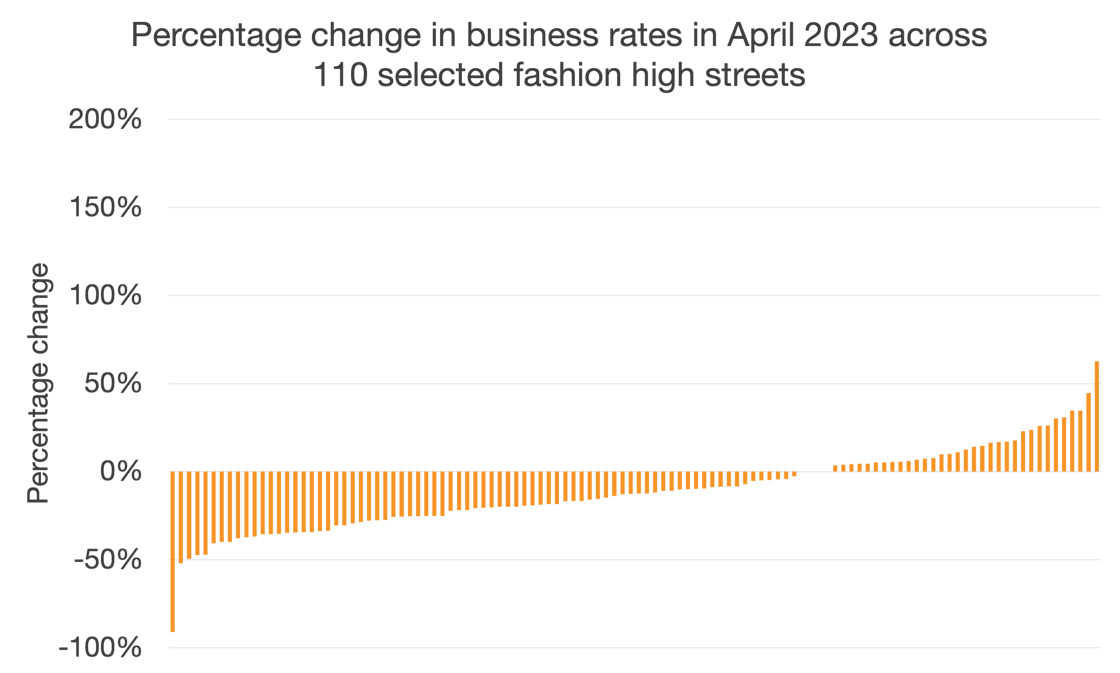

65 of the high streets surveyed were to see business rates fall by 10% or more in April 2023; across the 110 high streets selected, the average unit will see its rates bill fall by 18%. Compare this to April 2019, where only 37 of the high streets could expect a fall in business rates of more than 10%.

Figure 1: Percentage change in business rates across selected fashion-dominant high streets in England and Wales – April 2023 (Source: Local Data Company/VOA)

In terms of value, London locations were set for the biggest decrease in business rates this year. Oxford Street leads the way with an average decrease of £164,000 per year, with the next biggest decreases on Regent Street, Long Acre, George Street (Richmond) and Strand.

The key differences are in the magnitude of these changes: only 8 high streets will see business rates fall by 40% or more in April 2023, compared to April 2019 when 19 high streets saw their rates rise by 40% or more.

The question remains whether the policy has gone as far as it should to support occupiers, given not only the scale of the increases seen in April 2019, but the current economic climate marked by rising inflation, staff shortages and fragile consumer confidence.

Analysis correct as of April 2023.

901

901

901

901