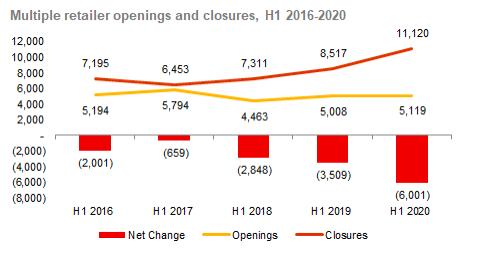

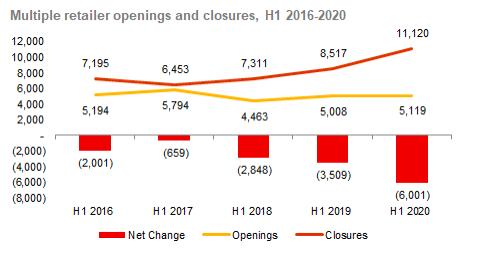

Shop closures have hit record levels with over twice as many net store closures in the first half of 2020 in comparison to last year, according to research by the Local Data Company and PwC UK. The data shows that 11,120 chain operator outlets have closed this year so far, with 5,119 shops opening, creating a net decline of 6,001, almost double the decline tracked last year (3509).

The steep decline comes amidst a challenging year for retail and leisure which has seen many stores have to close either temporarily or permanently as the impact of COVID-19 continues to influence consumer behaviour. The data shows that COVID-19 has accelerated previous trends that have changed the way consumers shop, so, although retail sales already recovered to pre-COVID 19 levels by July, there have been greater shifts in categories and channels. However, store openings of multiples, which have remained at broadly the same level over the past five years, also show that despite the acceleration in closures in 2020, there remains consistent demand for retail, hospitality and services that can only be delivered physically.

Lisa Hooker, consumer markets leader at PwC, said:

“We know that the pandemic will continue to impact the way we work, rest and play, however, in terms of how we shop, this isn't new. What we have seen is an acceleration of existing changes in shopping behaviours alongside forced experimentation from COVID-19 restrictions.

“We all knew that consumers were shifting to shopping online or changing their priorities in terms of the things they buy, but what COVID-19 has done is create a step change in these underlying trends to where they have now become the new normal.

“While it’s challenging for many, these results do prove a few positive things. Firstly, there’s been a resurgence of interest in local high streets. The practicalities of lockdown and the increase in working from home mean that independent shops tend to be located where consumers increasingly are.

“Plus a steady flow of openings, with the continued roll out of value retailers, the boom in takeaways and pizza delivery shops and demand for services that can still only be delivered locally such as tradesmen outlets, building products or locksmiths, shows that despite the stark numbers there remains a future for physical stores. We all still want and need to physically visit shops and leisure operators, it’s likely then that whatever happens retail will come out of this smaller but stronger”

Source: Local Data Company

Due to COVID-19, this year’s data covers the period from January to August, with no fieldwork undertaken during the national lockdown. In later months, sites that had yet to re-open have not been counted as closed, and may be included in future surveys.

In addition where previously this research only covered the top 500 high streets, this year's findings include all high streets, shopping centres and retail parks in Great Britain. Data has been recalculated for the last five years to allow comparisons.

On a sector by sector basis the categories which have seen consistent growth over the last five years include value retailers and discount supermarkets, highlighting the continued drive to seek value by consumers. In addition, the economics of delivering low-value goods mean that online alternatives are not available in many cases.

For leisure, the last five years have been dominated by the takeaway and coffee shop boom. And while many expect demand for coffee shops and food-to-go to be affected by any post-COVID-19 environment, leisure is likely to remain resilient in the shape of takeaways and pizza delivery shops.

For services, certain operators (such as banks and post offices) are likely to move away from the high street. However, those services that can still only be delivered physically (and therefore see little impact from online) may see growth such as local tradesmen outlets, building products and locksmiths.

For local authorities, it’s now critical to rethink how they respond to this significant and growing decline in store occupants. The pandemic has accelerated change and the profound impact of lockdown on local high streets, town centres and city centres is clear. Working as part of the High Streets Task Force with the Institute of Place Management and consortium partners, PwC has investigated the drivers behind the post-COVID-19 high street recovery to understand the pace and shape of the recovery across different locations and where intervention could boost high street recovery.

Jonathan House, devolved and local government lead partner at PwC, said:

“The role of local leaders and place makers in working with communities and businesses to set out a new vision for our high streets has never been more important. From the differing demands of local and long-distance visitors to the burgeoning afternoon economy, it is important that a more nuanced picture of the impact of COVID-19 is applied to each town or high street.

“There’s a once in a lifetime opportunity to reimagine high streets that are at the heart of our local communities and local economies. The high street won’t go back to how it was and can’t recover through the retail sector alone. Businesses, communities, local and central government need to come together and create liveable, vibrant and different places where people want to live, work and visit.”

Lucy Stainton, head of retail and strategic partnerships at The Local Data Company, said:

“The results from H1 2020 are a stark reminder of the challenges faced by retailers in the first 6 months of the year, which included a national lockdown. There are signs that this is just the tip of the iceberg, as 22% of the multiple market is still closed temporarily.

“With each week that passes since retail and hospitality businesses were given the green light to reopen, the likelihood of these occupiers ever trading again in those units reduces. This, alongside the impact of local lockdowns and other restrictions such as the 10pm curfew will continue to have a devastating impact on the sector with more closures likely to fall in Q1 2021 following the busier golden quarter.

“As with any economic turmoil, there are opportunities for retailers who are able to weather this storm, with the availability of prime property, increased activity and spend in local centres and changing consumer habits. Agile retailers who are able to innovate and adapt quickly, such as Pret launching its coffee subscription service or e-bike retailer Pure Electric who have opened 13 stores this year will be the most resilient as we head towards the end of a year which arguably has been the most challenging in recent history.”

For more detail on this story please visit https://www.pwc.co.uk/industries/retail-consumer/insights/store-openings-and-closures.html

ENDS

Notes to Editors

- PwC and the LDC’s analysis tracked 210,365 outlets operated by multiple retailers across Great Britain, between 1st January – 31st August 2020

- Multiples are retailers that have more than 5 outlets nationally and internationally

- The analysis is derived from The Local Data Company visiting 1,925 locations across GB. Each premises was visited and its occupancy status recorded as occupied, vacant or demolished. Vacant units are those units, which did not possess a trading business at that location on the day we visited it. Internal shopping centre data is included where we have had cooperation from the landlord. The total number of multiples premises surveyed was 210,365

- The town centre is defined as per DCLG’s definition of the retail core. Scotland has no official retail core geography so the geography taken is the postal town area where not specified otherwise. Net change is openings less closures. The percentage change is derived from the net change figure relative to the total number of live multiple businesses.

- For more information please visit the website https://www.pwc.co.uk/industries/retail-consumer/insights/store-openings-and-closures.html (live on Monday 19 October 2020)

901

901

901

901