We have previously commented on the long-term resilience of GB retail parks, which have historically seen lower vacancy rates than other location types, even weathering the pandemic well compared to high streets and shopping centres.

As a diverse asset class, representing abundant opportunities for all types of occupier, how have retail park tenants changed over the past ten years? How do these changes reflect wider market trends?

CLASSIFICATION MIX

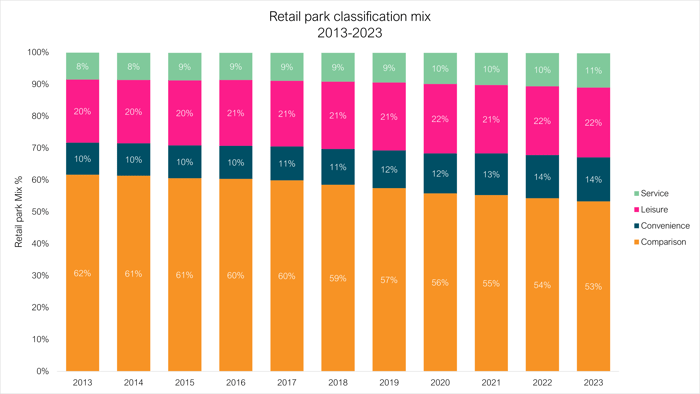

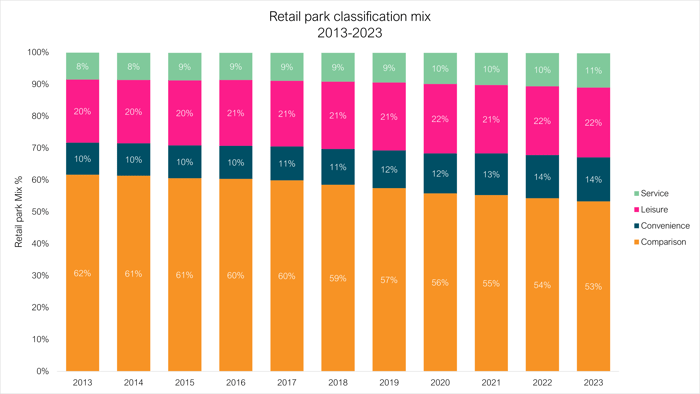

The tenant mix across retail parks has seen significant change over the last ten years. In terms of classification mix, the comparison sector has declined by 9% since 2013 across this asset type. This echoes the wider trend seen across the market, driven by major fashion and department store closures.

Figure 1: Retail park classification mix, 2013-2023 (Source: Local Data Company)

Figure 1: Retail park classification mix, 2013-2023 (Source: Local Data Company)

All other sectors have seen an increase in mix: convenience has increased by 4%, service by 3% and leisure by 2% in the ten-year period. Retail parks have been a notable target for several convenience retailers including Aldi, Lidl and Iceland’s The Food Warehouse, forming a prime focus in several expansion strategies. Helping to build out the ‘one-stop shop’ offer, several gym brands and drive-through concepts have also targeted retail parks as part of national and regional expansion plans.

CATEGORY CHANGES

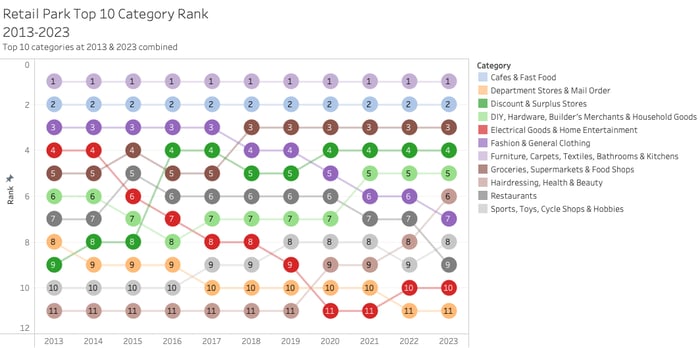

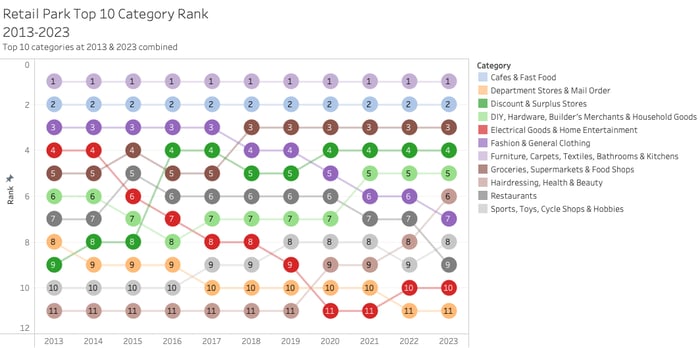

Looking at the top 10 categories present across GB retail parks between 2013 and 2023, we tracked the rank of each category based on total number of stores.

The cafés & fast food and furniture categories retained the first and second rank respectively throughout the ten-year period. Although the hospitality sector has seen its own challenges, seeing its share of closures across all location types, food categories were, of course, among the least impacted by the growing prevalence of online retail.

Figure 2: Change in retail category ranking across GB retail parks, 2013-2023 (Source: Local Data Company)

Across the ten years to 2023, the fashion & general clothing category dropped from third place to seventh, following the closures of the Arcadia group stores and brands such as Laura Ashley, which had a strong presence across retail park locations. The electrical goods category also saw a decline, from fourth place to tenth by 2023, following closures from retail park regulars such as Carphone Warehouse, PC World and Maplin.

On the other hand, discount stores rose from ninth place in 2013 to fourth in 2023, following aggressive expansion strategies from the likes of Home Bargains, B&M and Poundland. Meanwhile, health & beauty has also seen rapid growth across retail parks, rising from below tenth place in 2013 to land in the sixth place position this year— this was driven by gyms, with PureGym, The Gym Group and Everlast Fitness Club taking up space at retail parks.

RELOCATIONS TO RETAIL PARKS

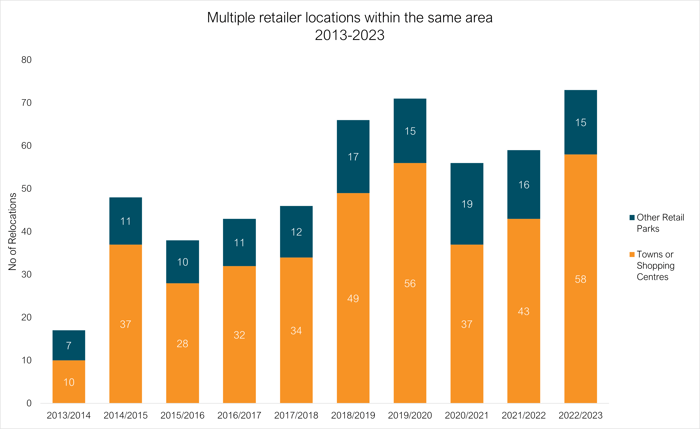

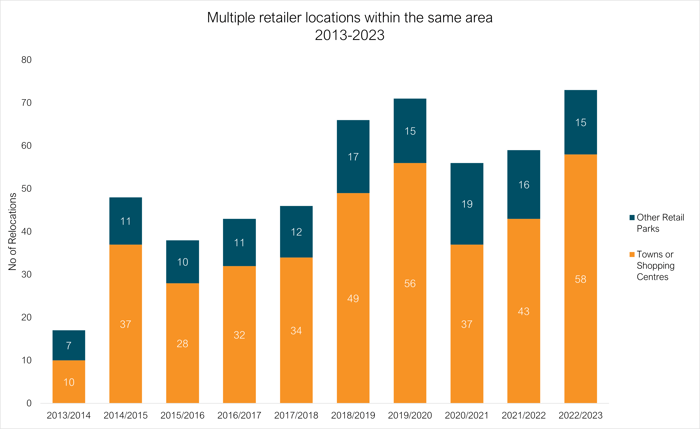

One of the prevailing trends in recent years has been larger retailers closing their smaller stores and relocating into larger retail park locations. This is one manifestation of the wider ‘flight to prime’ where retailers are looking for prime locations as they seek to consolidate their store portfolios.

LDC tracked all multiple retailers who closed a town centre or shopping centre store, then reopened in a retail park in the same area within two years. Also included in this analysis are retailers who closed sites in one retail park and opened within another in the same area within two years, suggesting the retailer judged the new park to offer a better unit size, improved proximity to (or distance from) other retailers or a more optimal tenant or customer mix.

Figure 3: Relocations within the same area by multiple retailers, 2013-2023 (Source: Local Data Company)

Figure 3: Relocations within the same area by multiple retailers, 2013-2023 (Source: Local Data Company)

Both these types of relocations have steadily increased between 2013 and 2020. The majority of relocations were from town centre and shopping centre locations to retail parks, rather than from one retail park to another. There was then a drop in relocations in the 2020-2022 period, as we would expect, as many retailers halted changes to their store portfolio amid pandemic-driven uncertainty.

The highest number of relocations within the same area took place in the 2022-2023 period. It remains to be seen if, and how, this trend is likely to continue in the coming years, as retailers strive to make more strategic decisions on their store portfolio and consolidate lower-performing stores.

LOOKING TO THE FUTURE

Retail parks offer several specific advantages for both retailers and customers, which may explain why they have continued to prove popular. For retailers, they can offer greater flexibility and affordability in terms of unit floorspace, and a wider range of options for using said space, compared to traditional high street locations. Customers are attracted to the number and variety of retailers in one location, and the relative ease of accessibility and parking that retail parks can offer.

The flexibility and ease of access available at retail parks may be a core factor in their continuing popularity, with the potential to support omnichannel retail and online order fulfilment, draw large catchments and provide space for an ever more diverse range of occupiers.

901

901

901

901

Figure 1: Retail park classification mix, 2013-2023 (Source: Local Data Company)

Figure 1: Retail park classification mix, 2013-2023 (Source: Local Data Company)

Figure 3: Relocations within the same area by multiple retailers, 2013-2023 (Source: Local Data Company)

Figure 3: Relocations within the same area by multiple retailers, 2013-2023 (Source: Local Data Company)