Contact name: Lucy Stainton, LDC Commercial Director

Organisation: The Local Data Company

Phone number: 07889591487

Email: press@localdatacompany.com

The GB retail and leisure market stabilises in advance of a tough winter ahead for retailers and consumers

A report released today by the Local Data Company shows marked signs of recovery across Great Britain’s retail and leisure market. The analysis, which covers the first half of 2022, indicates record performance for businesses, with the lowest level of store closures seen since H1 2018. Findings suggest that market activity has well and truly resumed following the pandemic, and the sector is in a strong position despite looming challenges.

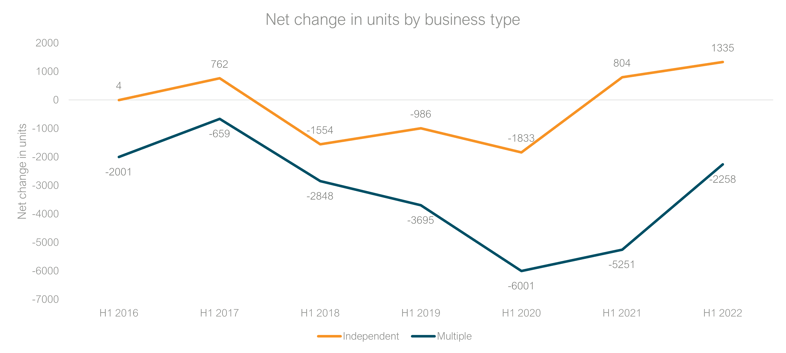

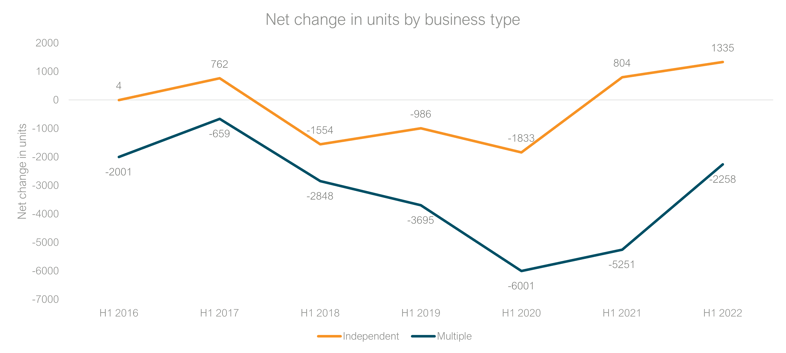

Figure 1: Historical net change in units across GB by business type, H1 2016- H1 2022 (Source: Local Data Company)

- The market has entered a period of recovery after the pandemic-driven shakeout which saw large numbers of store closures. Net change in retail and leisure units improved to -923 in H1 2022, the best result since H1 2017. There were far fewer retail casualties in this period, with the number of closures falling from 26,703 in H1 2021 to 24,832 in H1 2022, the lowest closures figure since H1 2018.

- After a challenging few years for chain retailers, they saw a significant year-on-year improvement, with 2,993 fewer closures than in H1 2021. Although still experiencing a net decline of -2,258 units in the first half of this year, this is a notable development, helping to close the gap between chains and independents (see figure 1). Most of the major closures seem to be over, leaving the more resilient stores behind and creating a state of certainty in the market.

- Independents continued to thrive in the market in H1 2022, with a net increase of 1,335 units, up from a net increase of 804 in H1 2021. The trend for shopping local has continued following the lockdown period, to the benefit of independent retailers such as convenience stores, which performed particularly well. This is encouraging given initial fears about how the end of the commercial rent moratorium and other government support could affect independents. However, rising operational costs could strongly impact independent stores in particular in H2 2022.

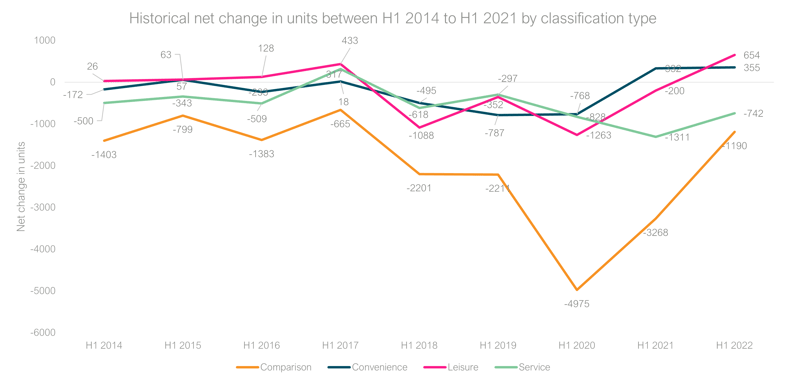

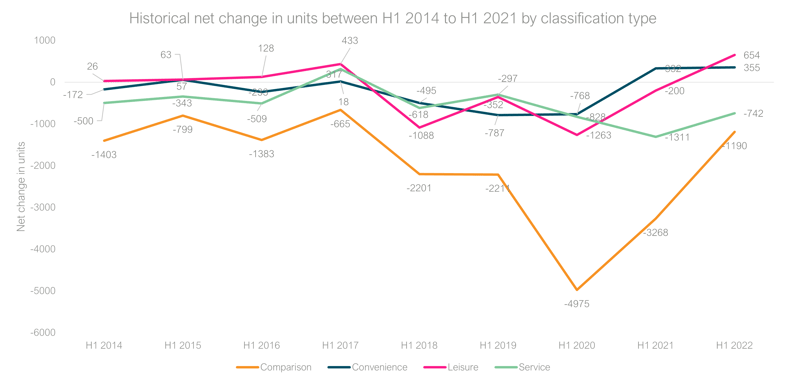

- All classifications saw a year-on-year improvement in terms of net change in units, but the most significant recovery was in the comparison classification, which had its best performance since H1 2017 (see figure 2). Although it still landed at a net loss of -1,190 units in H1 2022, this is an improvement of -2,078 on the previous year. Fashion shops in particular have made a strong recovery following the administrations and mass closures of the previous years. Domestic shoppers and international tourists have made a return to physical retail, as evidenced in declining levels of online spend.

Figure 2: Historical net change in units across GB by retail classification, H1 2014 – H1 2022 (Source: Local Data Company)

- Shopping centres have been a troubled location type for many years, hitting an all-time vacancy rate high in 2020 due to the rise of online shopping, compounded by a host of CVAs and administrations for major retailers. H1 2022 has been a much more positive period for shopping centres, with a welcome decrease in vacancies. Percentage net change in shopping centre units fell from -3.3% to -0.3% in the year to H1 2022. A host of investment and development plans are still in the pipeline across Britain’s shopping centre locations, which will influence further improvement for this sector.

- The leisure vacancy rate has continued to fall since 2020, dropping 0.4% over the first six months of the year. The hospitality sector was facing a bleak period following changes in government support this year, but it has performed admirably in spite of this. Independent hospitality has fared especially well, particularly fast food takeaways, independent cafés and new bar concepts, as vacant units presented opportunities for new tenants. As costs continue to rise, however, these businesses have a difficult H2 ahead.

Overall, the data shows that the market has landed in a much stronger position than previously anticipated, and the retail and leisure sector has moved into recovery following the disruption of the pandemic. As costs climb and consumer spending slows down, occupiers and investors are preparing for a difficult end to the year, and economists predict this will likely stretch into 2023.

Comment from Lucy Stainton, Commercial Director, Local Data Company:

“Our latest analysis of the physical retail and leisure market shows a remarkable level of recovery at a time when further economic headwinds have been well-documented. With store closures decreasing compared to the same time last year, in parallel with an increase in openings, the net decline in trading retail and hospitality businesses has softened significantly. The pandemic proved the final straw for a number of ailing retailers and this CVA and insolvency activity, which typified the most challenged end of the market during the COVID years, has now seemingly washed through.

Independents in particular have continued to flourish as consumers remain loyal to their local high streets. However, we can’t be naïve to oncoming economic pressures as consumers face a winter with less disposable income and increased caution. It feels that just as the market has started to find its feet, we are now about to face a new round of tests - but perhaps the lessons learned during the pandemic will prove fundamental to both chains and independents in enduring these too.

ENDS

Notes for editors

Please contact the LDC Press Office with any additional data or interview requests at press@localdatacompany.com or 07889591487.

The full report will be available to download via the LDC website on 22nd September. Please visit www.localdatacompany.com/insights/reports to access a copy.

The full report will include further detail on:

• Openings and closures

• Vacancy rates

• Regional trends

• Multiple vs independent performance

• Growing and declining retail and leisure categories

• Long-term vacancy rates

• Reoccupation of ex-Arcadia sites and department stores

Methodology

The Local Data Company visits over 3,300 towns and cities (retail centres and government-defined retail core), retail parks and shopping centres across England, Scotland and Wales.

Towns are updated on a 6- to 12-month cycle depending on size and churn, with both a field survey and office research team tracking changes in the local market.

Each centre has been physically walked and each premises recorded as vacant, occupied or demolished as recorded on the day of survey. Vacant units are units that did not have a trading business at that premise on the day of survey.

‘Retail’ refers to convenience retail, comparison goods retail and service retail, while ‘leisure’ refers to leisure destinations, namely entertainment venues, restaurants, bars, pubs & clubs, coffee shops and fast food outlets.

The GB vacancy rate analyses the top 650 town centres across England, Wales and Scotland.

H1 refers to the 6 month period of 1st January to 30th June.

H2 refers to the 6 month period of 1st July to 31st December.

About the Local Data Company

The Local Data Company is the UK’s most accurate retail location insight company. We track openings and closures activity for every retail and leisure business across the country. Our data, analytics and insights power strategy and decision-making for businesses working across retail, leisure, out-of-home media, investment, property and financial services.

We employ a team of field researchers who physically audit the occupancy status of every business at frequent intervals, which enables us to capture live information about how the market is changing in real time. The ability to collect such accurate data is strengthened through our proprietary technology stack, developed in-house, which supports our field research and quality control processes. We employ the most innovative development techniques to constantly improve our products and services, be that the core data on over 680,000 businesses, our location insight dashboards or our analytics and consultancy arm.

For more information, please see www.localdatacompany.com.

901

901

901

901