In this latest insight blog, we explore the relationship between housing growth and retail vacancy rates, utilising data from Edge Analytics.

Based on the period of 2017-2022, we took the five local authorities with the highest percentage housing growth and the five local authorities with the lowest percentage housing growth (England and Wales only) for comparison.

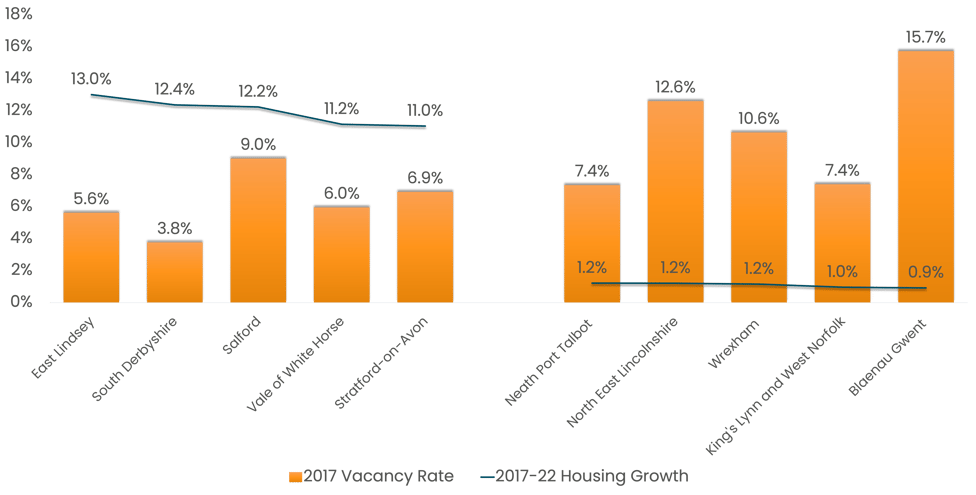

Figure 1 compares the 2017 retail vacancy rates and 2017-22 housing growth for the five local authorities with the highest housing growth during that period with the five lowest.

2017 retail vacancy rate and 2017-22 housing growth by local authority

Figure 1: 2017 retail vacancy rate and 2017-22 housing growth by local authority. (Source: Local Data Company and Edge Analytics)

Blaenau Gwent had the highest retail vacancy rate of all 10 featured local authorities in 2017 (15.7%), with the local authority subsequently witnessing the lowest housing growth of all GB local authorities during the next five years at just 0.9%.

With the exception of Salford, which had a retail vacancy rate of 9.0% in 2017, 2017 retail vacancy rates were lower in the cohort of local authorities with the highest percentage housing growth between 2017 and 2022 than the five local authorities that experienced the lowest percentage growth.

This suggests that higher occupancy of retail and leisure premises on the high street generally translates to increased demand for local housing and therefore greater housing growth in the subsequent period, although there are clearly many other factors at play.

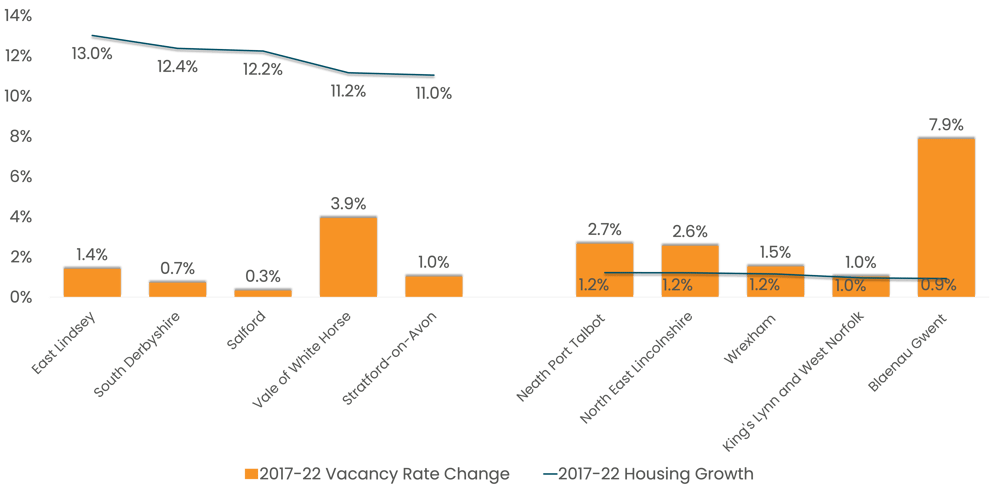

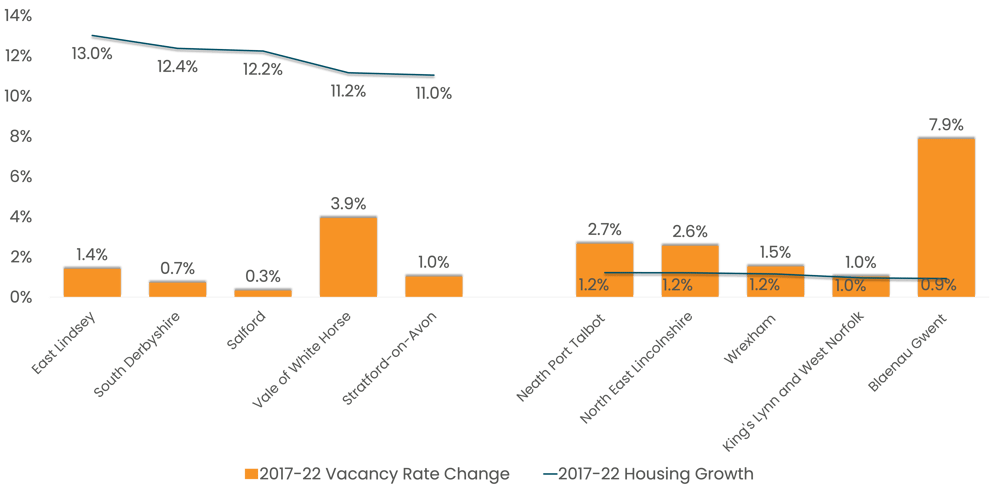

Figure 2 compares the 2017-22 retail vacancy rate change and 2017-22 housing growth for the five local authorities with the highest and lowest housing growth during that period.

2017-22 retail vacancy rate change and 2017-22 housing growth by local authority

Figure 2: 2017-22 retail vacancy rate change and 2017-22 housing growth by local authority. (Source: Local Data Company and Edge Analytics)

Again, Blaenau Gwent, which witnessed the lowest housing growth of any local authority between 2017 and 2022, also suffered an increase in retail vacancy of 7.9% during this time – by far the highest increase of the 10 featured local authorities.

Although the Vale of White Horse encountered an increase in retail vacancy of 3.9% over these five years, the average increase in retail vacancy was much lower in the five local authorities with the highest percentage housing growth (1.5% vs. 3.1% ). Comparing to the wider GB average (2.7%), it shows that areas that saw significant housing growth saw their retail and leisure markets remain more resilient.

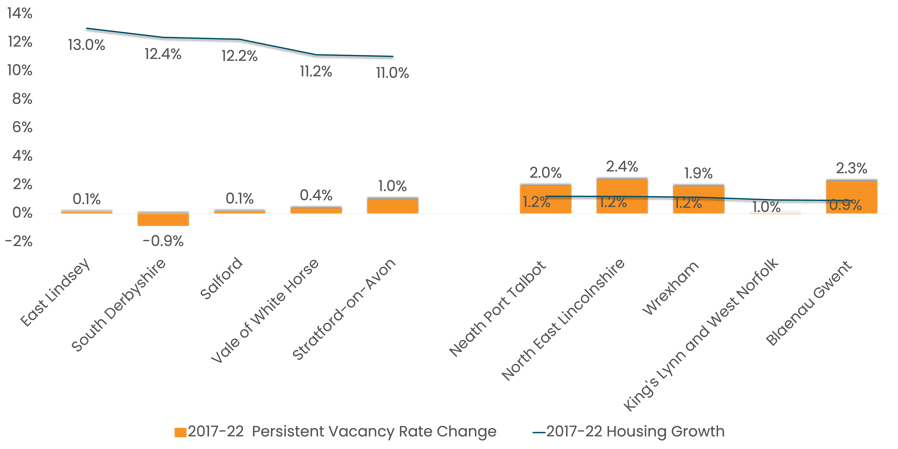

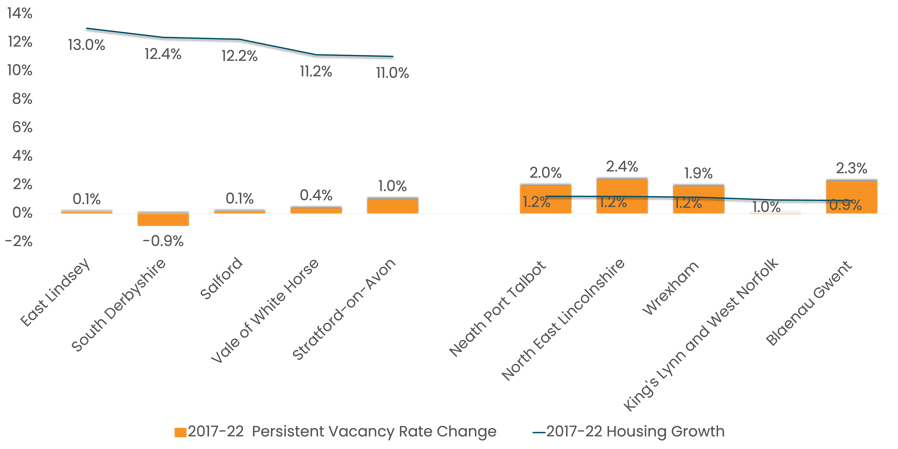

Looking at the impact of housing growth on persistent retail vacancy – units vacant for greater than three years – we can see how this was impacted by housing growth with many of these units in need of redevelopment into other uses such as housing.

2017-22 persistent retail vacancy rate change and 2017-22 housing growth by local authority

Figure 3: 2017-22 persistent retail vacancy rate change and 2017-22 housing growth by local authority. (Source: Local Data Company and Edge Analytics)

Figure 3 shows the change in persistent retail vacancy alongside the housing growth figures for the 10 selected local authorities. Four of the five local authorities encountering the lowest percentage house growth of all local authorities in England and Wales between 2017 and 2022 also suffering more significant rises in persistent retail vacancy than the cohort with the highest house growth during this period.

The one exception was King’s Lynn and West Norfolk which witnessed no change in persistent retail vacancy between 2017 and 2022. With King’s Lynn – a population of less than 50,000 – being by far the biggest conurbation in this largely rural local authority and a large proportion of residents living and shopping out of town, this local authority was more immune from the increase in retail vacancy rates witnessed in major town centres throughout Great Britain during this period.

South Derbyshire – which experienced a 12.4% increase in housing stock – encountered a 0.9% fall in persistent retail vacancy during this same period.

The relationship between retail vacancy and housing growth means that information and insight on retail vacancy rates from the Local Data Company alongside housing growth forecasting from Edge Analytics can help location planners to predict locations where the future demand for additional retail provisions and leisure services are most likely to arise.

This blog offers clients an introduction into how housing growth impacts occupancy levels, for a more deeper dive clients can contact our relationship managers to find out how this data could be added to your subscription.

901

901

901

901