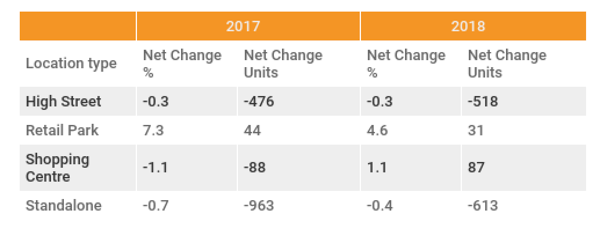

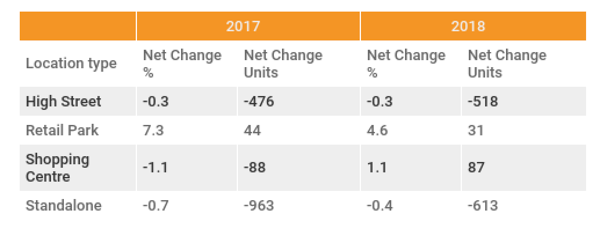

Data released today by the Local Data Company and the British Independent Retailers Association (Bira) shows that 2018 saw growth in the number of independent stores in shopping centres, with 1,951 new openings leading to a net gain of +87 (+1.1%) compared to a net decline of -88 in 2017 (-1.1%). Independent retailers played key role in replacing the net loss of -811 chains in shopping centres - due to retailers rationalising estates. Shopping centre owners are becoming increasingly creative with vacant space, splitting it into smaller units which are more suitable for independent occupiers.

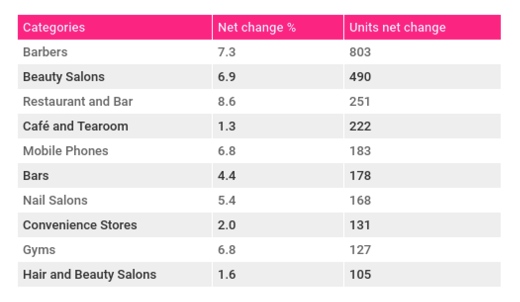

The analysis, which reviews changes across more than 313,000 independent businesses across Great Britain also found that overall, independent retailers opened 4.5% more shops in 2018 than in 2017. This number was offset by a record number of stores closing (35,524), which led to an overall net decline of -1,013 shops. However, this is a 32% improvement from the decline of -1,483 shops in 2017. Losses were offset by Leisure categories (cafes, restaurants, bars and pubs) and Service retail categories (hairdressers, barbers and dry cleaners) which were the only categories to see growth in 2018, with a net increase of +710 and +992 units respectively.

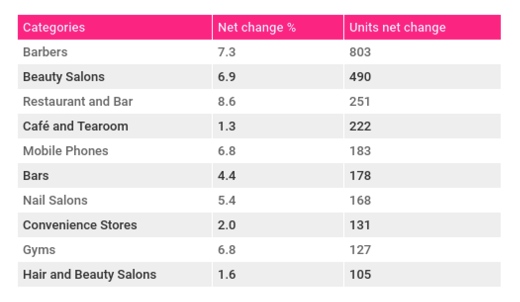

A key area of growth in the independent sector was Barbers, seeing an increase of +803 units. This represents a +7.3% net increase in numbers in the 12-month period. Barbers have been growing for five years straight and 2018 saw growth accelerating 30% from the +619 net increase in 2017.

Other key findings

- In 2018, independents accounted for 64% of all retail and leisure units in Great Britain.

- A total of 70,035 independents either opened (34,511) or closed (35,524) up +4% up on 2017 where 67,503 opened (33,010) or closed (34,493).

- Numbers of independent Leisure units (restaurants, cafes & entertainment)increased by +75% in 2018. In 2018 there was a net increase of +710 units (11,080 openings and 10,370 closures), versus a net change of +132 in 2017.

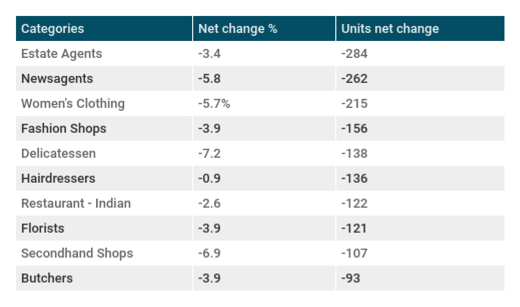

- The independent Comparison Goods retail category (non-perishable goods such as clothes, books and homewares) saw a net change in units of -2.45% in 2018 (-2.62% in 2017). This is a net decrease of -2,125 units; a marginal improvement on 2017 (-2,240).

- The independent Convenience retail category (grocery and convenience stores) experienced a net decline of -590 units in 2018 versus a net decline of -266 units in 2017. This was the only sector to not see an improvement with competition from chain operators becoming more evident.

- Service retail (hair and nail salons, tattoo parlours and dry cleaners) was another category to see growth 2018 of +992 units (+1.0% versus +0.9% in 2017). This was predominantly driven by barbers.

- Key growth categories have been Barbers, Beauty salons, Restaurant & Bar concepts and Coffee shops. (see table 1 for figures)

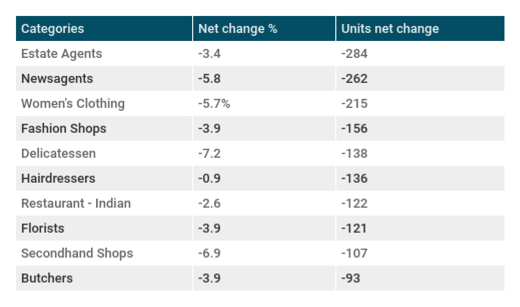

- Categories in decline include Estate agents, Newsagents, Women’s clothing shops, and Fashion shops. (see table 2 for figures)

- Independent Vegan (+52%) and Jamaican restaurants (+15%) have increased the most as a percentage of their total estate.

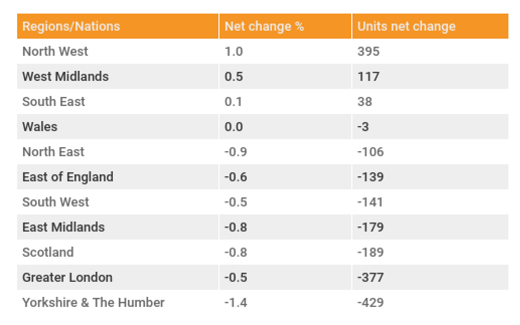

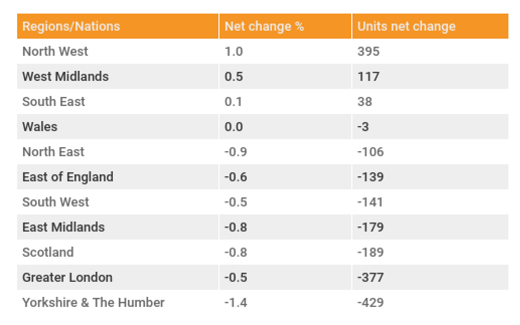

- The North West showed the greatest increase of independents at +395 units (+1.0%) in 2018, versus +1 unit (+0.0%) in 2017.

- Yorkshire & the Humber and Greater London showed the greatest decline of independents at -429 units (-1.4%) and -377 units (-0.5%) respectively

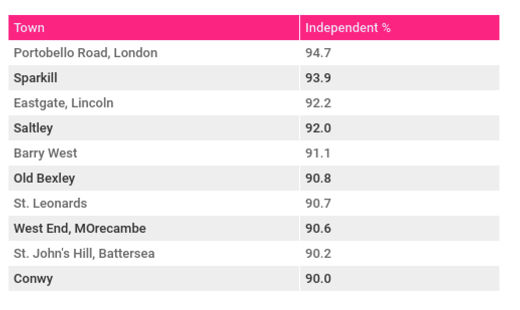

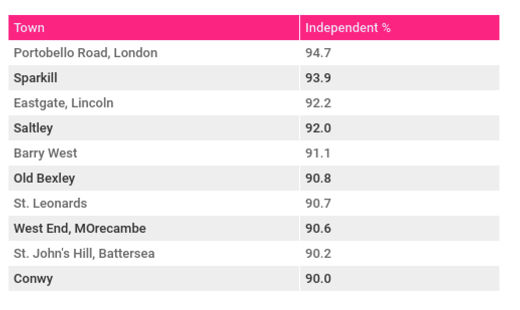

- Portobello Road in London has the accolade of having the highest percentage of independent businesses at 95% (based on locations with 50+ total units).

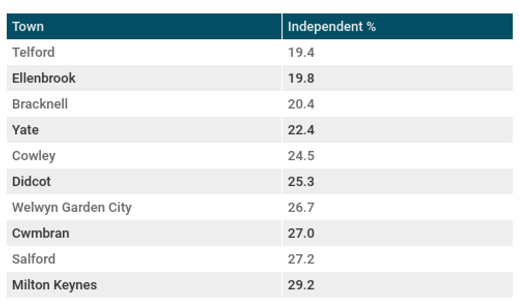

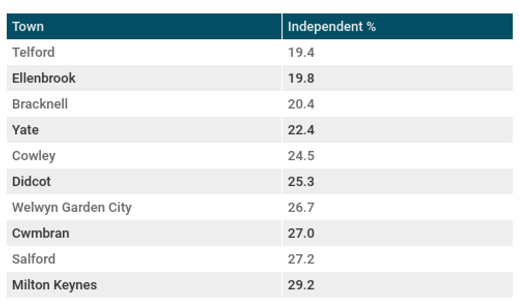

- Telford is the town with the lowest percentage of independents at only 19%, against a GB average of 64% (based on locations with 50+ units).

- High streets saw no change in fortunes when compared to the previous year, with a decline in independent retailers of -0.3% in both 2017 and 2018 . Retail parks continued to see growth with a +4.6% increase (versus +7.3% in 2017), however this location type only accounts for 0.2% of all independents across GB.

Top 10 independent retail categories by openings

Table 1. Top retail categories by growth in numbers in 2018 across GB (Source: Local Data Company)

Top 10 independent retail categories by closures

Table 2. Top retail categories by decline in numbers in 2018 across GB in 2018 across GB (Source: Local Data Company)

Percentage of independent stores by GB regions and nations

Table 3. Net percentage change in independent units by GB region in 2018 (Source: Local Data Company)

Top 10 independent towns (50+ units)

Table 4. GB towns with the highest percentage of independent retailers (Source: Local Data Company)

Bottom 10 independent towns (+50 units)

Table 5. GB towns with the lowest percentage of independent retailers (Source: Local Data Company)

Change in numbers of independent businesses by location type

Table 6. Net change in numbers of independent businesses by location type in 2018 (Source: Local Data Company)

Table 6. Net change in numbers of independent businesses by location type in 2018 (Source: Local Data Company)

Lucy Stainton, Head of Retail and Strategic Partnerships, the Local Data Company commented:

“2018 saw many well-known brands exit the high street and rationalise estates of bricks and mortar stores. A by-product of this activity was a plethora of units in prime locations coming into the market, which agile entrepreneurs have been quick to reoccupy. This, combined with more a creative approach to property by shopping centre managers has resulted in a new breed of independent shopping centre occupiers. Increasing independent businesses in these assets has benefits for the owner, bringing diversity and differentiation into the retail offer. For independent business owners, the benefits include increased footfall and access to marketing via promotional websites and campaigns.

In the coming months and years, we expect a similar pattern for retail parks. Whilst historically they have hosted big-box brands with large stores, recent challenges for retailers in this market will force retail park owners to review the structure of their assets, breaking up larger units up to attract a new type of retailer and make units for viable for independent retailers.”

Andrew Goodacre, CEO, British Independent Retailers Association (Bira), said

“Seeing growth in certain areas is encouraging to see. We’ve certainly noticed the increase in service-based retail. Even traditional retailers are seeing the benefits of diversifying and offering a service in their store that consumers can’t get online - whether this be key cutting, coffee, treatments or even workshops and demonstrations.

“However, the overall net decline of -1,013 shops shows independents are struggling. Business rates continue to be a huge burden on independent retail businesses. On top of this parking in town centres is reduced and often very expensive, there is poor infrastructure and there has been a lack of local authority vision and investment. We will continue to fight to level the playing field for retail as a whole and allow bricks and mortar retailers the chance to compete with online.”

For more information on the GB retail and leisure market, including independent and multiple businesses, download our latest free report by clicking the image below.

901

901

901

901

Table 6. Net change in numbers of independent businesses by location type in 2018 (Source: Local Data Company)

Table 6. Net change in numbers of independent businesses by location type in 2018 (Source: Local Data Company)